As business energy consultants, we are constantly on the lookout for the finest deals on the market for our clients, and we work tirelessly to achieve these. Our monthly market reports provide views directly from our specialists. Use our price analysis, market signals, and political changes to help you make the right choice when it comes to energy decisions.

Download PDFDisclaimer: The information contained in this document has been prepared in good faith by Ginger Energy and provides our views on current/future trends and outcomes, but, as with all forecasts dependent upon multiple, complex variables, there is no certainty whatsoever that our forecasts will turn out to be correct. The information may be based on licenced 3rd party data, publicly available sources, assumptions, and observable market conditions and may change without notice. No warranty, express or implied, is made as to the accuracy, correctness, fitness for purpose, completeness or adequacy of this information nor is it intended to serve as basis for any procurement decision and as such Ginger Energy shall not accept any responsibility or liability for any action taken, financial or otherwise, as a result of this information. Please note that this email is intended for the recipient only and may not be copied, reproduced, or distributed without the prior consent of Ginger Energy.

Market Context

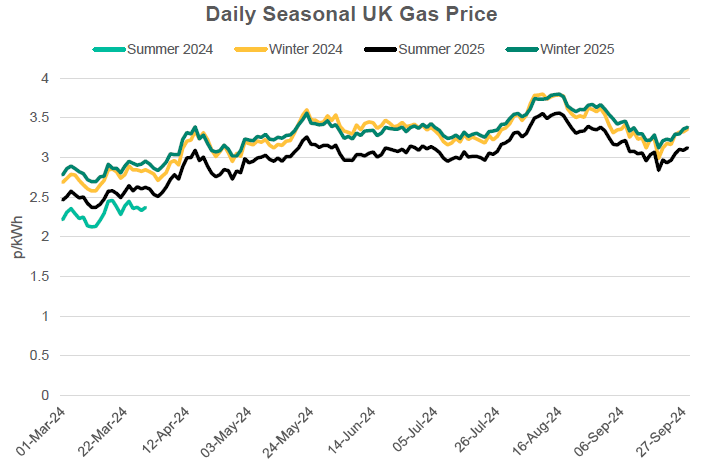

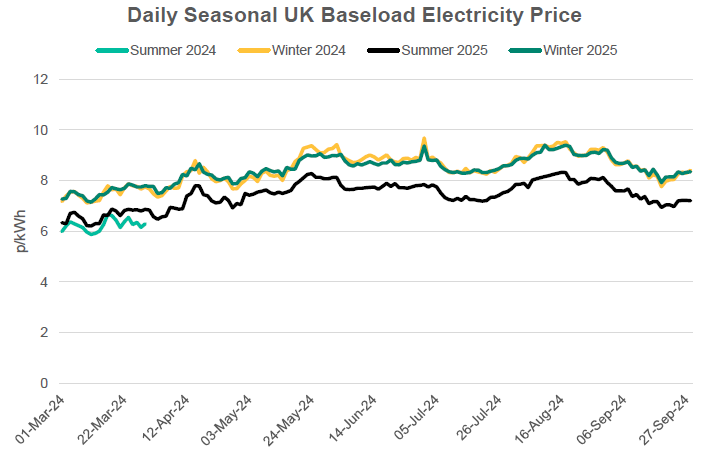

For the majority of September, seasonal prices demonstrated a bearish trend descending from the high point of the year witnessed in August. However, escalating tensions in Ukraine/Russia and in the Middle East shifted the momentum in the last 10 days of the month. This resulted in seasonal prices ending the month around 7-10% lower despite, at a brief moment, being almost 20% lower than the start of the month.

- False news of transit agreement between Azerbaijan and Ukraine to keep Russian gas flowing into Europe next year pushed markets down nearly 10% in a single trading session.

- The news of the agreement was not backed up by official sources which led to a quick retracement of the losses and the start of the change in momentum.

- Risk to US LNG supply due to hurricanes came and went without materialising.

- The conflict in Ukraine/Russia escalated with President Putin setting out new terms upon which they would see it appropriate to utilise nuclear weapons.

- In the Middle East after several communication device attacks fighting intensified between Israel and Hezbollah with Israel launching an offensive into Lebanon.

- Storage across Europe is currently over 94% which is just short of the record high witnessed at this time last year.

In other news

- Cornwall Insight, a leading provider of energy research and analysis, has warned small businesses that they will continue to face higher energy costs. Although bills have stabalised after the energy crisis they are still expected to be around 70% more than 2020-21 levels. They stated the only way to deliver sustainable lower energy bills was to increase domestic generation.

Seasonal Prices

Price Table

Seasonal prices fell month-on-month despite rising geopolitical tensions across the globe. Front month gas prices show an increase as the front month moved from being a summer delivery month to a winter one with the seasonality of gas usage driving higher prices across winter months.

Month End Prices

Spot Prices

| Fuel | Sep-24 (p/kWh) | Aug-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.16 | 3.21 | -1% |

| Power (UK Baseload) | 7.18 | 6.63 | 8% |

Front Months

| Fuel | Sep-24 (p/kWh) | Aug-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.18 | 3.24 | 14% |

| Power (UK Baseload) | 7.68 | 8.19 | -6% |

Front Season

| Fuel | Sep-24 (p/kWh) | Aug-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.36 | 3.62 | -7% |

| Power (UK Baseload) | 8.41 | 9.31 | -10% |

Annual Price (Oct-24)

| Fuel | Sep-24 (p/kWh) | Aug-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.29 | 3.55 | -7% |

| Power (UK Baseload) | 7.87 | 8.78 | -10% |

Historical Comparison

| Fuel | 2019 Average Front Season Price (p/kWh) | % Increase to Sep-24 |

|---|---|---|

| Gas (NBP) | 1.64 | 105% |

| Power (UK Baseload) | 5.10 | 65% |

Outlook

Despite strong levels of storage currently, many analysts believe that anything other than a mild winter scenario could leave storage levels uncomfortably low at end of winter. A cold scenario could see them completely depleted. A last-minute transit deal to continue the flow of Russian gas into Europe could provide some bearish pressure but overall, the winter risk appears skewed towards the upside.

Bearish Signals

- Entering winter with strong storage.

- Expectation of continued robust Norwegian production.

- A last-minute transit deal to continue the flow of Russian gas through Ukraine.

Bullish Signals

- Higher gas-for-power demand forecast compared to last winter.

- Decrease in LNG supply winter-on-winter.

- End of Russian piped imports through Ukraine in January 2025.

Want the best energy and water contracts for your business?

Ginger Energy can help you.

We take the time to understand your needs and handle everything with the supplier on your behalf. Throughout the entire life on your contract, we’re always on hand to help. And, there’s obligation to stick with us – you contract directly with the supplier, not with you..

Get in touch today to start saving money and time spent on finding the best business energy deals.