As business energy consultants, we always have our finger on the pulse, working tireless to help our customers get the best deal on the market. These monthly market reports give you insights directly from our experts. Use our price analysis, market signals, and political changes to help you make the right choice when it comes to your energy.

Download PDFDisclaimer: The information contained in this document has been prepared in good faith by Ginger Energy and provides our views on current/future trends and outcomes, but, as with all forecasts dependent upon multiple, complex variables, there is no certainty whatsoever that our forecasts will turn out to be correct. The information may be based on licenced 3rd party data, publicly available sources, assumptions, and observable market conditions and may change without notice. No warranty, express or implied, is made as to the accuracy, correctness, fitness for purpose, completeness or adequacy of this information nor is it intended to serve as basis for any procurement decision and as such Ginger Energy shall not accept any responsibility or liability for any action taken, financial or otherwise, as a result of this information. Please note that this email is intended for the recipient only and may not be copied, reproduced, or distributed without the prior consent of Ginger Energy.

Market Context

September saw an end to the strike action at LNG plants in Australia but a heavy Norwegian maintenance schedule, impacting flows to the UK, prevented seasonal markets from losing too much value. Overall though the month did witness downward momentum continuing the theme from 2023 so far.

- Chevron had planned to take unions to court to try and force an agreement to prevent further LNG strikes in Australia.

- Prior to the court date Chevron and the unions came to an agreement which halted strike action and removed the need for court action.

- A heavy Norwegian maintenance schedule combined with extensions and unplanned outages created pressure on supply and demand dynamics over the month.

- A short-term issue at Freeport LNG export facility in Texas caused a drop in production which created a moment of panic – but this was short lived as the plant resumed normal operation shortly after.

- Total EU gas storage has passed the 95% mark.

In other news

The UK prime minister, Rishi Sunak, announced plans to roll back on several Net Zero commitments previously made by the Conservative government.

Plans to slow down the transition to electric vehicles were amongst a list of items to receive attention. The announcement was met with widespread criticism, especially from car manufacturers who have planned substantial investment in the UK to support with the transition to EV’s.

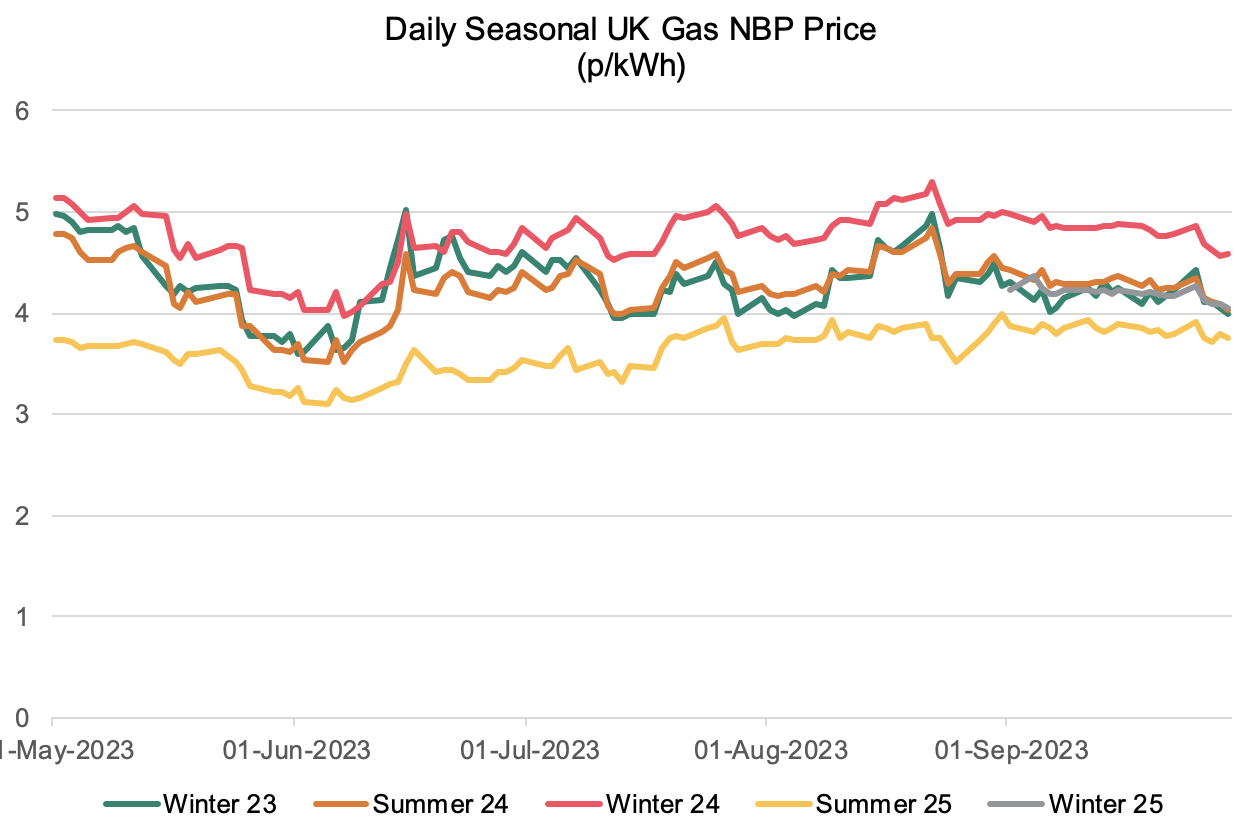

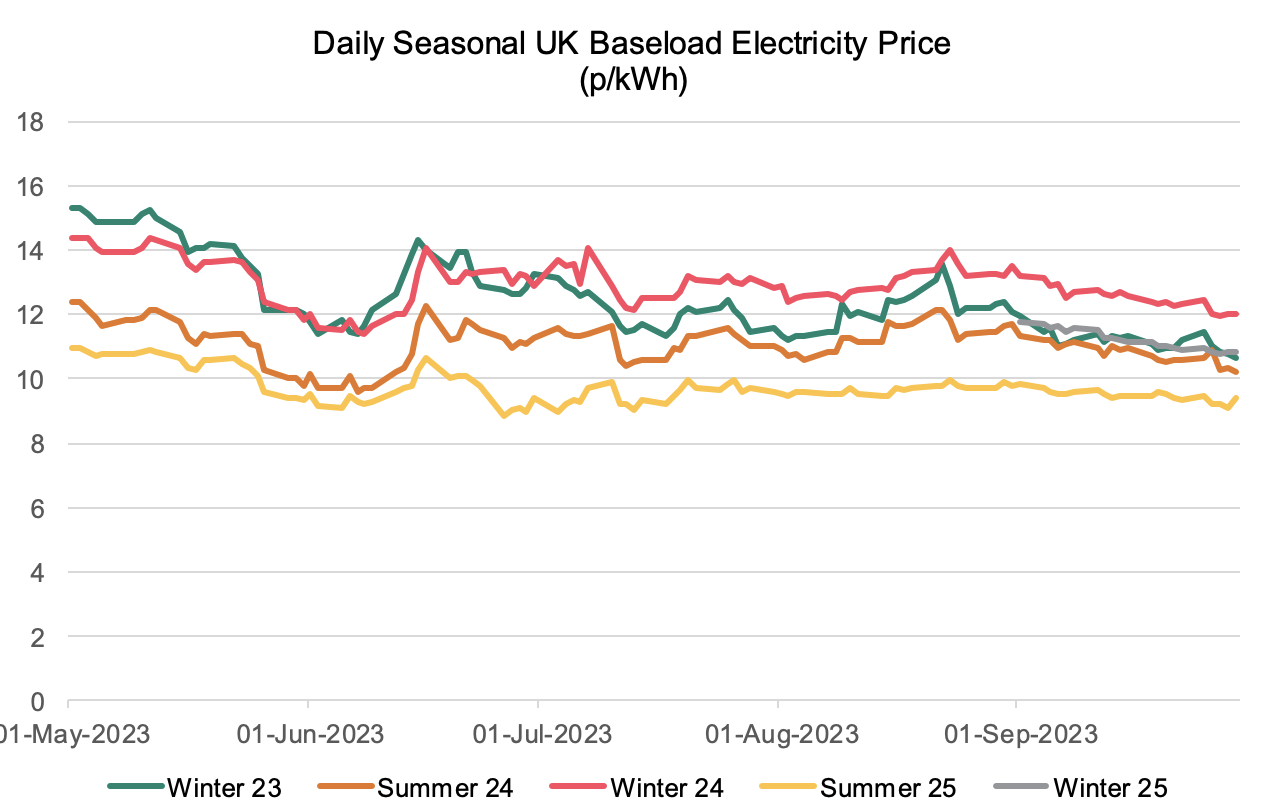

Seasonal Prices

Price Table

Despite some volatility within the month, Front Season prices ended September down for both gas and electricity showing a continuation of the bearish trend we have seen for much of 2023. Front season prices are now just under 2.5x higher than 2019 levels.

Month End Prices

Spot Prices

| Fuel | Sep-23 (p/kWh) | Aug-23 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.23 | 2.75 | 18% |

| Power (UK Baseload) | 8.82 | 9.11 | -3% |

Front Months

| Fuel | Sep-23 (p/kWh) | Aug-23 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.29 | 2.75 | 12% |

| Power (UK Baseload) | 8.70 | 8.63 | 1% |

Front Season

| Fuel | Sep-23 (p/kWh) | Aug-23 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.98 | 4.27 | -7% |

| Power (UK Baseload) | 10.62 | 12.05 | -12% |

Annual Price (Oct-23)

| Fuel | Sep-23 (p/kWh) | Aug-23 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 4.00 | 10.43 | -8% |

| Power (UK Baseload) | 4.00 | 10.43 | -12% |

Historical Comparison

| Fuel | 2019 Average Front Season Price (p/kWh) | % Increase to Sep-23 |

|---|---|---|

| Gas (NBP) | 1.64 | 143% |

| Power (UK Baseload) | 5.10 | 108% |

Outlook

The balance of drivers seem to suggest the bearish trend will continue into October; especially as initial forecasts are for a mild start to the winter season. However, now we have entered the winter period, cold weather rears its head as a constant bullish risk factor.

Bearish Signals

- NWE gas storage over 95% full.

- Increased LNG arrivals scheduled.

- Above seasonal normal temperatures forecast for the first half of October.

- Demand destruction in the industrial sector is set to continue.

Bullish Signals

- Risk of cold winter weather becomes a factor.

- Growth in Asian LNG demand.

- Unplanned outages or disruption to supply.

Want the best energy and water contracts for your business?

Ginger Energy can help you.

We take the time to understand your needs and handle everything with the supplier on your behalf. Throughout the entire life on your contract, we’re always on hand to help. And, there’s obligation to stick with us – you contract directly with the supplier, not with you.

Get in touch today to start saving money and time spent on finding the best business energy deals.