As business energy consultants, we are constantly on the lookout for the finest deals on the market for our clients, and we work tirelessly to achieve these. Our monthly market reports provide views directly from our specialists. Use our price analysis, market signals, and political changes to help you make the right choice when it comes to energy decisions.

Download PDFDisclaimer: The information contained in this document has been prepared in good faith by Ginger Energy and provides our views on current/future trends and outcomes, but, as with all forecasts dependent upon multiple, complex variables, there is no certainty whatsoever that our forecasts will turn out to be correct. The information may be based on licenced 3rd party data, publicly available sources, assumptions, and observable market conditions and may change without notice. No warranty, express or implied, is made as to the accuracy, correctness, fitness for purpose, completeness or adequacy of this information nor is it intended to serve as basis for any procurement decision and as such Ginger Energy shall not accept any responsibility or liability for any action taken, financial or otherwise, as a result of this information. Please note that this email is intended for the recipient only and may not be copied, reproduced, or distributed without the prior consent of Ginger Energy.

Market Context

Geopolitics and threats to global oil and gas infrastructure, due to the ongoing conflicts, continued to drive much of the long-term market movement. Throughout the month prices yo-yoed rising over 10% by the 25th before retracing some of those gains to close the month around 5% up on the end of September.

- Middle East tensions continued to escalate with Israel continuing offensives in Gaza and Lebanon whilst also exchanging attacks with Iran.

- Israel confirmed the death of Hamas leader Yahya Sinwar. Despite it being described as Israel’s biggest victory so far in the fight against Hamas, Benjamin Netanyahu has warned that the war is not over yet.

- Oil prices were volatile as the risks of Israel attacking energy infrastructure was present, however, missile attacks launched into Iran so far have avoided damage to any critical energy locations.

- The Ukrainian Prime Minister confirmed that the gas transit deal with Russia will not be extended into 2025, however, towards the end of the month reports that an agreement between Azerbaijan and Ukraine had been arranged to replace the Russian flows. An official announcement is yet to be released but the rumours provided bearish pressure for the market.

- Storage remained healthy, closing the month around 96% full thanks to mild weather throughout most of October.

In other news

- Clean Energy Investment Surge: The UK government recently announced over £24 billion in private investments aimed at accelerating clean energy projects. Key initiatives include Ørsted’s expanded offshore wind plans and Iberdrola’s doubled UK investment, among others. This influx of funding is expected to stimulate green jobs across the nation, including in regions like Teesside and Suffolk.

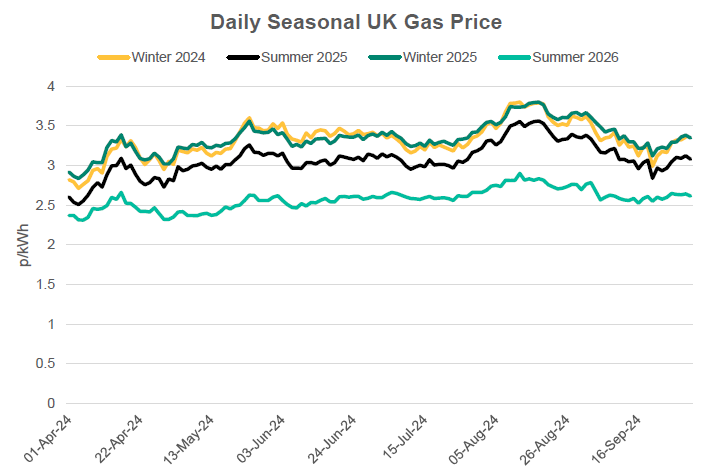

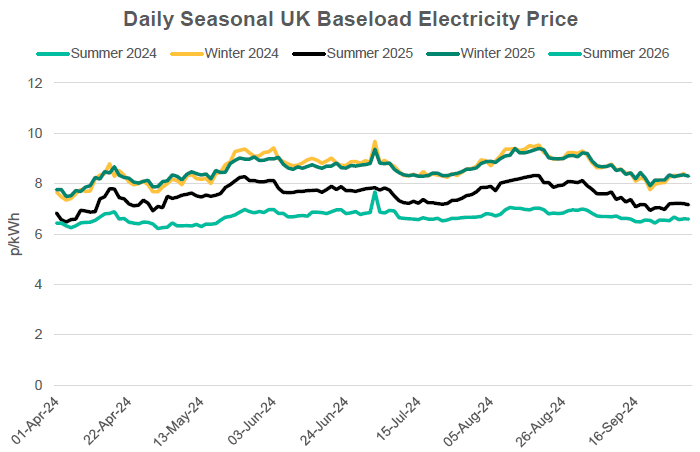

Seasonal Prices

Price Table

Prompt and Front month contracts rose substantially from the end of September to the end of October indicating the beginning of the heating season where weather becomes an important price driver. Seasonal prices fluctuated across the month but ended up around 5%*. *the below front season prices don’t correlate as the front season has moved from Winter to Summer.

Month End Prices

Spot Prices

| Fuel | Oct-24 (p/kWh) | Sep-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.36 | 3.16 | 6% |

| Power (UK Baseload) | 9.01 | 7.18 | 26% |

Front Months

| Fuel | Oct-24 (p/kWh) | Sep-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.44 | 3.18 | 31% |

| Power (UK Baseload) | 8.85 | 7.68 | 15% |

Front Season

| Fuel | Oct-24 (p/kWh) | Sep-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.28 | 3.36 | -2% |

| Power (UK Baseload) | 7.46 | 8.41 | -11% |

Annual Price (Oct-24)

| Fuel | Oct-24 (p/kWh) | Sep-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.40 | 3.29 | 3% |

| Power (UK Baseload) | 7.94 | 7.87 | 1% |

Historical Comparison

| Fuel | 2019 Average Front Season Price (p/kWh) | % Increase to Oct-24 |

|---|---|---|

| Gas (NBP) | 1.64 | 100% |

| Power (UK Baseload) | 5.10 | 46% |

Outlook

As we are now in the winter season weather and weather forecasts will start to influence price direction more and more. Geopolitical risks remain in play in both the Middle East and Ukraine/Russia. Demand is still looking likely to be subdued unless cold weather pushes up residential demand. All-in-all risks are slightly skewed towards the upside despite continued strong storage across Europe. Confirmation of a transit agreement between Ukraine and Azerbaijan could provide grounds for a bearish move.

Bearish Signals

- Entering winter with strong storage.

- Subdued power sector demand.

- Suggestion of slow Eurozone manufacturing recovery.

- Agreement of new transit agreement in Ukraine.

Bullish Signals

- Potential cold weather increasing residential heating demand.

- Unexpected infrastructure damage or unplanned maintenance.

- Geopolitical uncertainty.

Want the best energy and water contracts for your business?

Ginger Energy can help you.

We take the time to understand your needs and handle everything with the supplier on your behalf. Throughout the entire life on your contract, we’re always on hand to help. And, there’s obligation to stick with us – you contract directly with the supplier, not with you..

Get in touch today to start saving money and time spent on finding the best business energy deals.