As business energy consultants, we are constantly on the lookout for the finest deals on the market for our clients, and we work tirelessly to achieve these. Our monthly market reports provide views directly from our specialists. Use our price analysis, market signals, and political changes to help you make the right choice when it comes to energy decisions.

Download PDFDisclaimer: The information contained in this document has been prepared in good faith by Ginger Energy and provides our views on current/future trends and outcomes, but, as with all forecasts dependent upon multiple, complex variables, there is no certainty whatsoever that our forecasts will turn out to be correct. The information may be based on licenced 3rd party data, publicly available sources, assumptions, and observable market conditions and may change without notice. No warranty, express or implied, is made as to the accuracy, correctness, fitness for purpose, completeness or adequacy of this information nor is it intended to serve as basis for any procurement decision and as such Ginger Energy shall not accept any responsibility or liability for any action taken, financial or otherwise, as a result of this information. Please note that this email is intended for the recipient only and may not be copied, reproduced, or distributed without the prior consent of Ginger Energy.

Market Context

Prices moved up throughout March opposing the trend we have seen for the majority of 2024. A combination of intermittent supply, increasing Asian demand, and geopolitical factors in both the Middle East and Ukraine/Russian caused front season prices to rise around 10%.

- Production cuts at one of the largest gas producers in the US sparked an upward surge in the market.

- A ship was sunk off the cost of Yemen demonstrating increased tensions in the region.

- Attacks in Ukraine damaged gas infrastructure and terrorist attacks in Moscow created further tension.

- North Sea gas flows were impacted by a combination of maintenance and testing.

- Low LNG arrivals during the month as Freeport LNG in the US continues to experience low output.

- Storage ended winter period at c.57% which is higher than last years and significantly higher than the 5-year average of around 40%.

In other news

In other news, the prime minister has announced that the UK needs to build new, gas-fired power stations to ensure the country’s energy security. The new stations would replace existing plants, many of which are aging and will soon be retired. The announcement did not include measures for climate change-limiting carbon capture which means that they could threaten a legally binding commitment to cut carbon emissions to net zero by 2050, critics say.

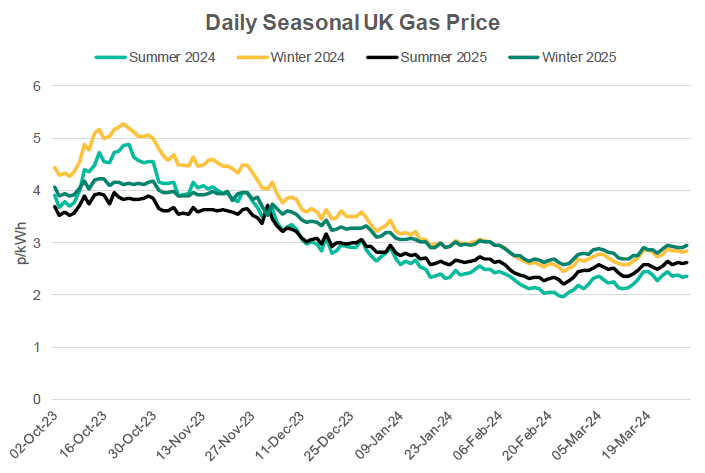

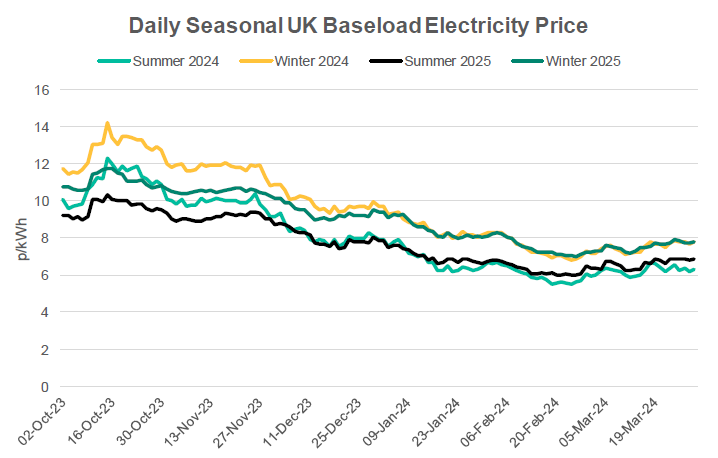

Seasonal Prices

Price Table

Prices across the curve generally rose throughout March as a combination of geopolitical and fundamental drivers pushed prices up from the low levels witnessed in February.

Month End Prices

Spot Prices

| Fuel | Mar-24 (p/kWh) | Feb-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.34 | 2.15 | 9% |

| Power (UK Baseload) | 5.45 | 6.33 | -14% |

Front Months

| Fuel | Mar-24 (p/kWh) | Feb-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.36 | 2.13 | 16% |

| Power (UK Baseload) | 6.16 | 5.95 | 3% |

Front Season

| Fuel | Mar-24 (p/kWh) | Feb-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.37 | 2.12 | 12% |

| Power (UK Baseload) | 6.30 | 5.91 | 6% |

Annual Price (Oct-23)

| Fuel | Mar-24 (p/kWh) | Feb-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.70 | 2.49 | 8% |

| Power (UK Baseload) | 7.10 | 6.61 | 7% |

Historical Comparison

| Fuel | 2019 Average Front Season Price (p/kWh) | % Increase to Mar-24 |

|---|---|---|

| Gas (NBP) | 1.64 | 45% |

| Power (UK Baseload) | 5.10 | 23% |

Outlook

If Geopolitical events generally continue to take a backseat, then the outlook is skewed towards bearish with the strong fundamental outlook set to continue through the summer period. The small bounce prices witnessed through March may be an indication of markets finding a comfortable level post the energy crisis.

Bearish Signals

- Record high storage stocks for the time of year.

- Lighter Norwegian maintenance schedule in the coming months.

- Demand destruction across heating demand and industrial sectors continue in line with EU commissions recommendations.

Bullish Signals

- Continuing geopolitical risk of regional escalation in Middle East and Red Sea.

- LNG supply expected to be lower in the coming months.

- Expiry of Russian transit contract via Ukraine is impending with uncertainty around future transit.

Want the best energy and water contracts for your business?

Ginger Energy can help you.

We take the time to understand your needs and handle everything with the supplier on your behalf. Throughout the entire life on your contract, we’re always on hand to help. And, there’s obligation to stick with us – you contract directly with the supplier, not with you..

Get in touch today to start saving money and time spent on finding the best business energy deals.