As business energy consultants, we always have our finger on the pulse, working tireless to help our customers get the best deal on the market. These monthly market reports give you insights directly from our experts. Use our price analysis, market signals, and political changes to help you make the right choice when it comes to your energy.

Download PDFDisclaimer: The information contained in this document has been prepared in good faith by Ginger Energy and provides our views on current/future trends and outcomes, but, as with all forecasts dependent upon multiple, complex variables, there is no certainty whatsoever that our forecasts will turn out to be correct. The information may be based on licenced 3rd party data, publicly available sources, assumptions, and observable market conditions and may change without notice. No warranty, express or implied, is made as to the accuracy, correctness, fitness for purpose, completeness or adequacy of this information nor is it intended to serve as basis for any procurement decision and as such Ginger Energy shall not accept any responsibility or liability for any action taken, financial or otherwise, as a result of this information. Please note that this email is intended for the recipient only and may not be copied, reproduced, or distributed without the prior consent of Ginger Energy.

Market Context

At the start of the December, we witnesseda sharp decline amidst strong fundamentals. Mid-month there was a short blip with Red Sea disruption causing momentary concern before a return of the bearish pressure. This decline continued over the festive period.

- The first half of month witnessed a sharp downturn off the back of strong fundamentals.

- Norwegian flows, LNG arrivals, and North-west Europe storage were all in a very healthy state.

- A short cold snap early in the month had little impact due to the strong supply position.

- BP were followed by several other firms when they announced a temporary pause in all shipments through the Red Sea amidst concerns regarding rebel attacks in the area which caused markets to spike, in some cases 10%, very briefly.

- In a matter of hours markets settled back down due to the realisation that this would lead to delays rather than loss of supply. Also, several western nations stepped in to provide security in the area creating calm in the market. Further attacks later in the month again failed to disrupt the market.

- North-west Europe gas storage ended December at 87% which is around 13% higher than the 5-year average.

In other news

At COP28, held in Dubai during December, an agreement was reached which has been called the “beginning of the end” of the fossil fuel era. The ground was laid out for a swift, just and equitable transition which will be underpinned by deep emissions cuts and scaled-up finance.

Critics claimed the language used was grossly insufficient, incoherent, and did not go nearly far enough to meet the challenge faced.

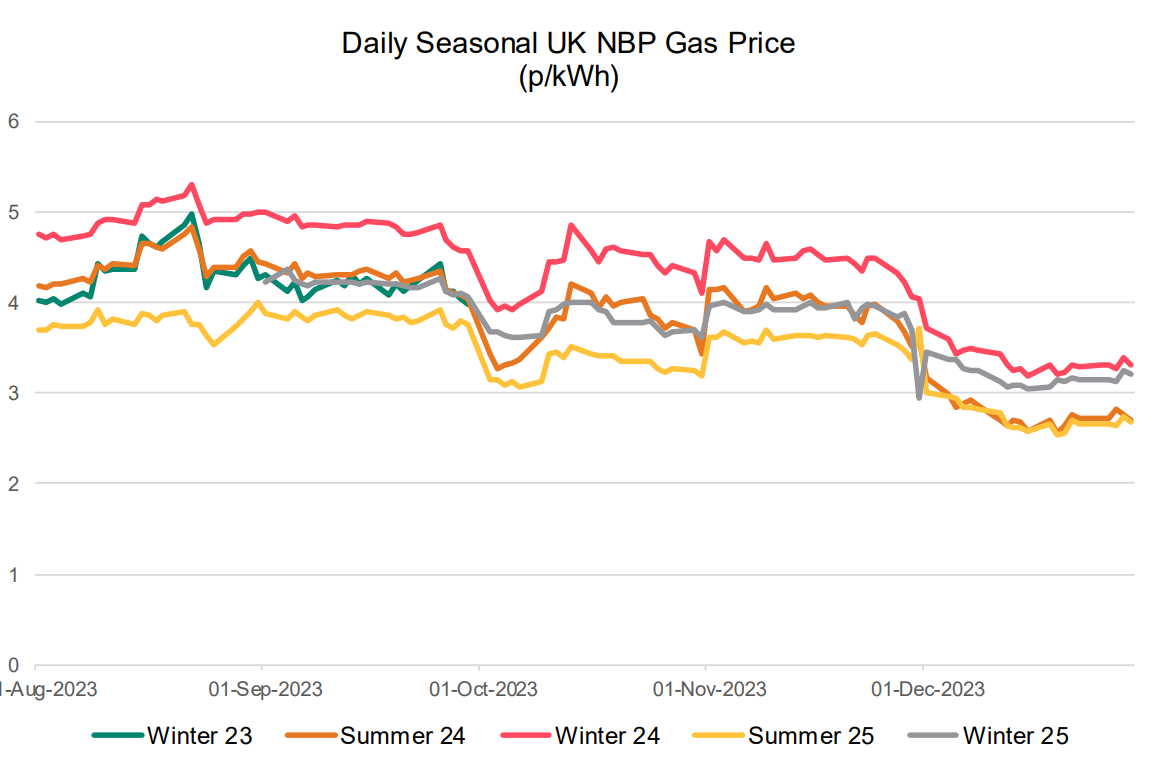

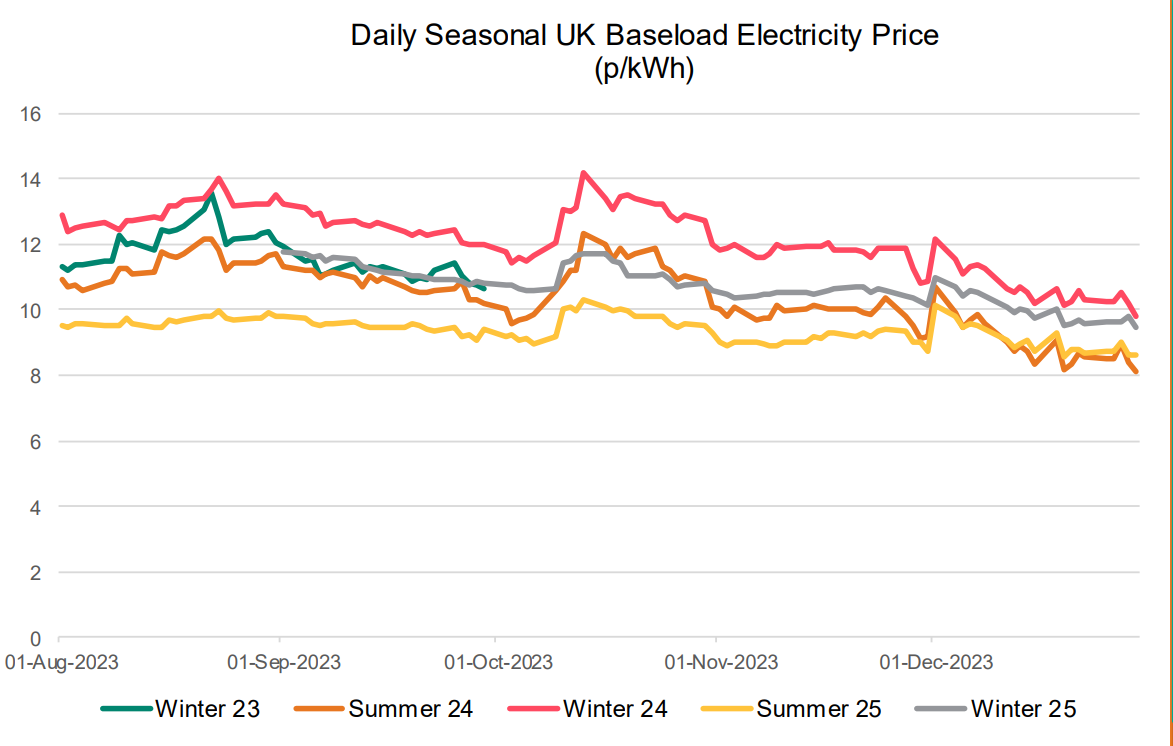

Seasonal Prices

Price Table

During December prices dropped significantly off the back of strong supply and storage creating a fundamental backdrop to drive bearish price movement. Front season prices are now between 50-70% higher than 2019, the lowest they have been for a long time.

Month End Prices

Spot Prices

| Fuel | Dec-23 (p/kWh) | Nov-23 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.68 | 3.64 | -26% |

| Power (UK Baseload) | 5.94 | 14.18 | -58% |

Front Months

| Fuel | Dec-23 (p/kWh) | Nov-23 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.76 | 3.53 | -11% |

| Power (UK Baseload) | 8.65 | 9.09 | -5% |

Front Season

| Fuel | Dec-23 (p/kWh) | Nov-23 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.76 | 3.60 | -23% |

| Power (UK Baseload) | 7.89 | 9.15 | -14% |

Annual Price (Dec-23)

| Fuel | Dec-23 (p/kWh) | Nov-23 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.17 | 3.90 | -19% |

| Power (UK Baseload) | 8.88 | 10.10 | -12% |

Historical Comparison

| Fuel | 2019 Average Front Season Price (p/kWh) | % Increase to Dec-23 |

|---|---|---|

| Gas (NBP) | 1.64 | 69% |

| Power (UK Baseload) | 5.10 | 55% |

Outlook

As we edge further into winter without any extreme cold weather the storage outlook for the end of March continues to be very positive. We are now at the point where even with a “beast from the east” type scenario storage levels should be extremely healthy. This provides clear bearish pressure on prices. However, geopolitical events or infrastructure disruption could still provide bullish signals.

Bearish Signals

- NWE gas storage forecast to continue to remain at record high at end of Jan ‘24.

- Norwegian exports on track to hit historical highs with high output expected to continue in January.

- LNG arrivals to NWE are expected to increase further in January.

- Demand destruction across domestic and industrial sectors set to continue.

Bullish Signals

- Further escalation or widening of the conflict in the Middle East.

- Weather forecasts could be revised lower.

- Lower prices could lead to increase in industrial demand.

- Unplanned outages or disruption to supply infrastructure.

Want the best energy and water contracts for your business?

Ginger Energy can help you.

We take the time to understand your needs and handle everything with the supplier on your behalf. Throughout the entire life on your contract, we’re always on hand to help. And, there’s obligation to stick with us – you contract directly with the supplier, not with you.

Get in touch today to start saving money and time spent on finding the best business energy deals.