As business energy consultants, we always have our finger on the pulse, working tirelessly to help our customers get the best deal on the market. These monthly market reports give you insights directly from our experts. Use our price analysis, market signals, and political changes to help you make the right choice when it comes to your energy.

Download PDFDisclaimer: The information contained in this document has been prepared in good faith by Ginger Energy and provides our views on current/future trends and outcomes, but, as with all forecasts dependent upon multiple, complex variables, there is no certainty whatsoever that our forecasts will turn out to be correct. The information may be based on licenced 3rd party data, publicly available sources, assumptions, and observable market conditions and may change without notice. No warranty, express or implied, is made as to the accuracy, correctness, fitness for purpose, completeness or adequacy of this information nor is it intended to serve as the basis for any procurement decision and as such Ginger Energy shall not accept any responsibility or liability for any action taken, financial or otherwise, as a result of this information. Please note that this email is intended for the recipient only and may not be copied, reproduced, or distributed without the prior consent of Ginger Energy.

Market Context

Seasonal Continuation – at any point in time the price represents the cost of buying energy to be delivered for the next immediate season (e.g., the price in January 24 would represent the cost of energy to be delivered in Summer 24 (Apr 24-Sep 24) when in April the price represents the cost of energy to be delivered in Winter ‘24 (Oct 24-Mar 25).

Seasonal Continuation Daily Energy Prices

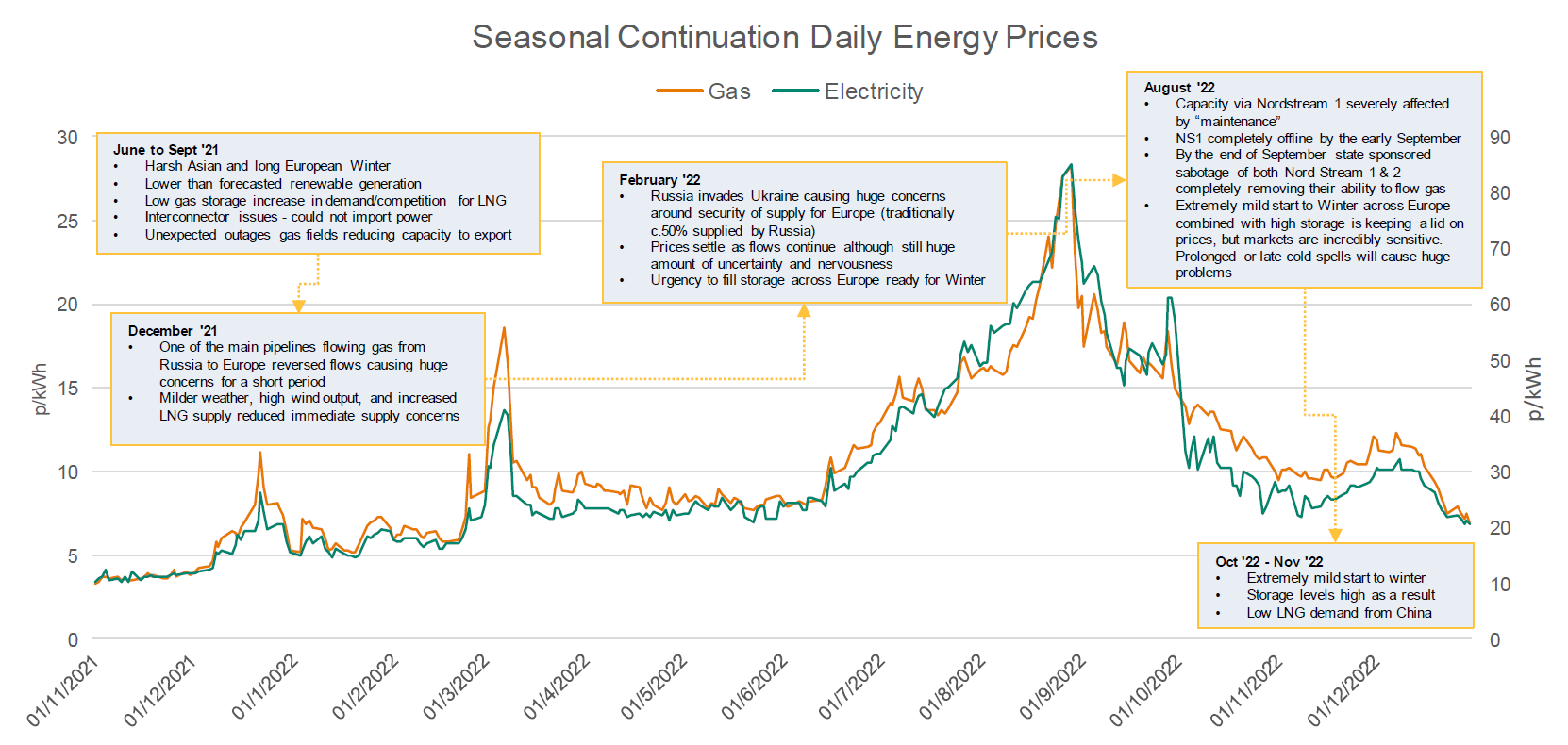

Daily Energy Prices 2021/2022

Currently around 40% of electricity in the UK is generated by burning gas which results in gas and electricity prices being strongly correlated.

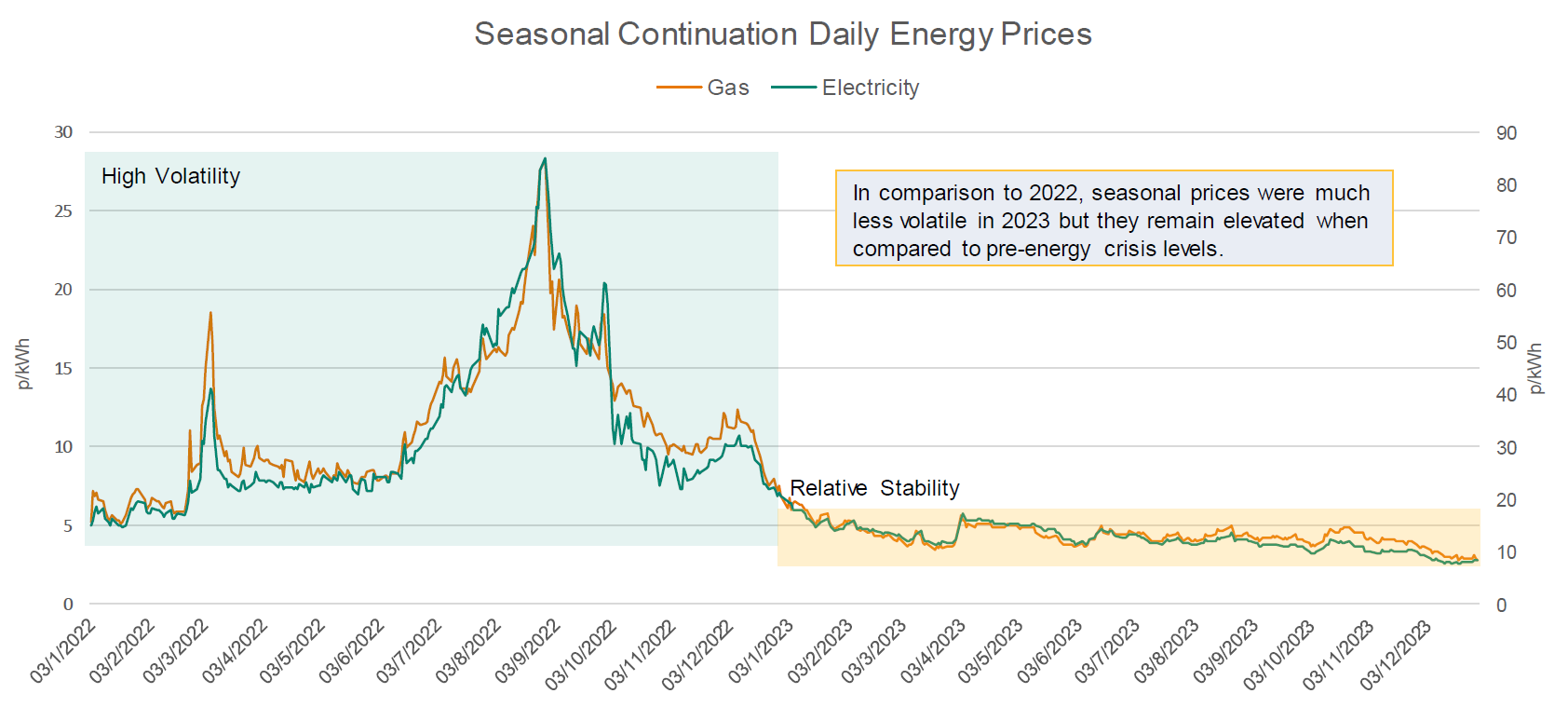

Seasonal prices shifted from high volatility in 2022 to relative stability in 2023

In comparison to 2022, seasonal prices were much less volatile in 2023 but they remain elevated when compared to pre-energy crisis levels.

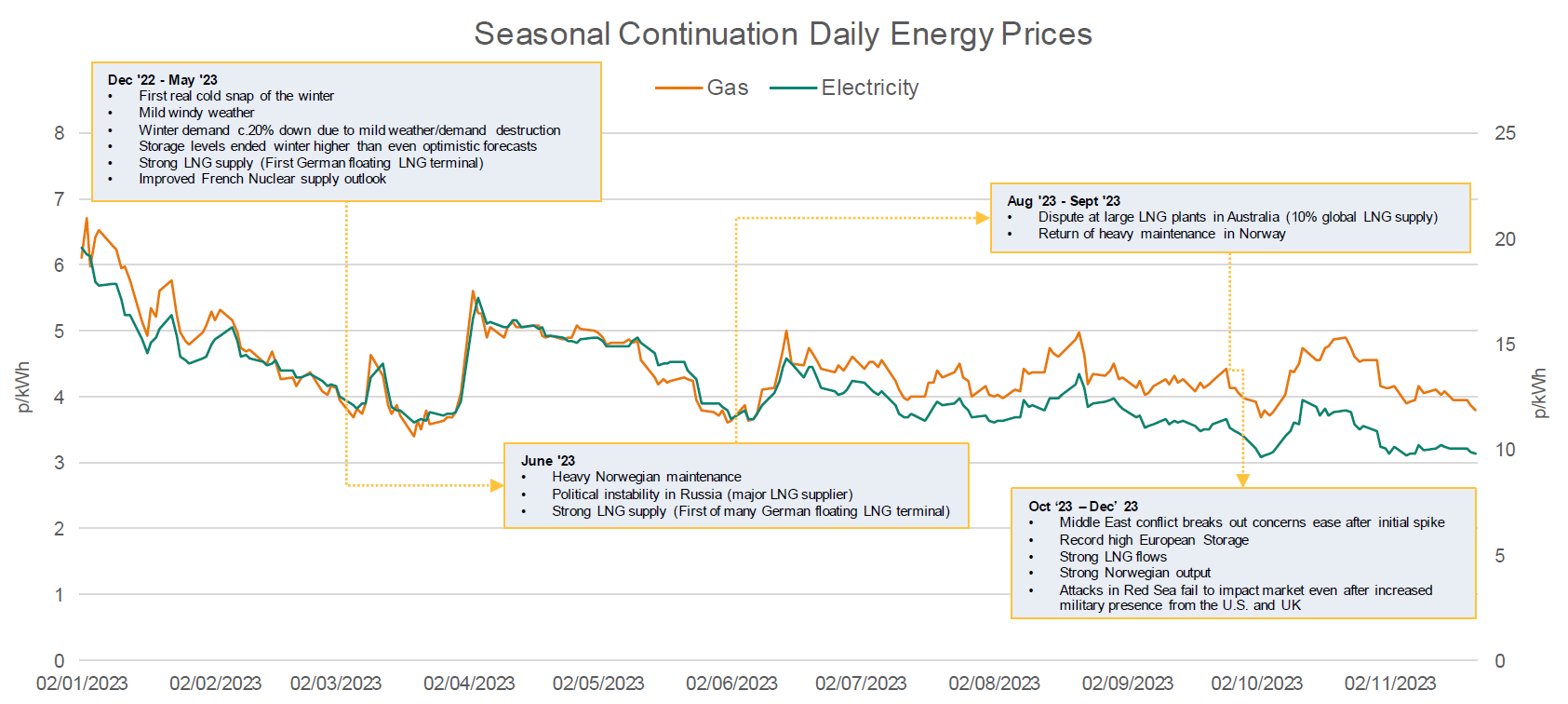

Despite geopolitical headwinds in 2023, market prices trended down

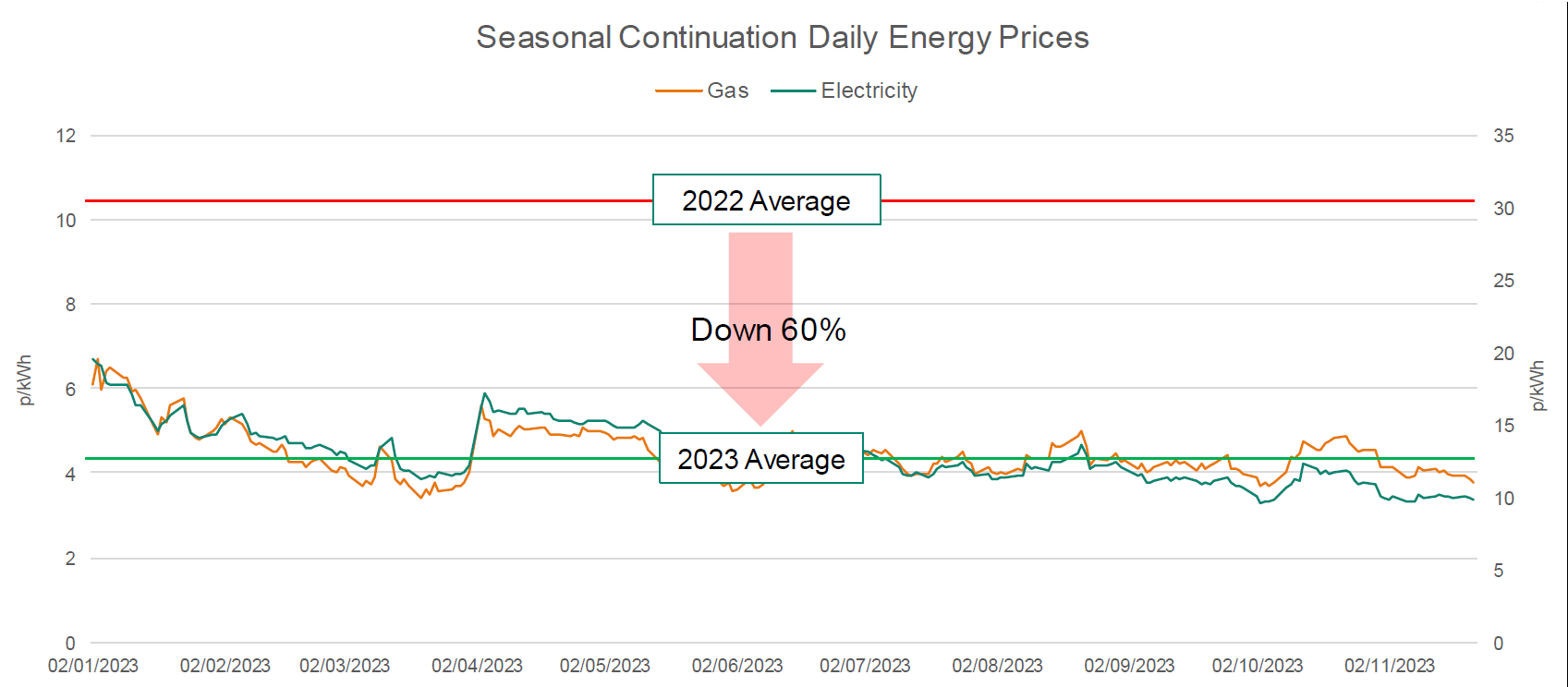

Average seasonal prices for 2023 were significantly lower than 2022

Average seasonal continuation price YoY

Prices from 2023 were over 3x higher than pre-energy crisis levels.

Average Gas Prices YoY

Gas prices increased by 167%, comparing 2023 vs. 2019.

| Description | Year | Gas | YoY Difference |

|---|---|---|---|

| Pre-energy Crisis | 2019 | 1.6 | n/a |

| Covid – low global energy demand | 2020 | 1.1 | -33% |

| Economic rebound leading on to the start of energy crisis | 2021 | 3.2 | 197% |

| Peak of crisis due to removal of Russian piped gas | 2022 | 11.3 | 250% |

| “New Normal” relative stability | 2023 | 4.3 | -62% |

Average Electricity Prices YoY

Electricity prices were also up 146%, looking at 2023 vs. 2019.

| Description | Year | Electricity | YoY Difference |

|---|---|---|---|

| Pre-energy Crisis | 2019 | 5.1 | n/a |

| Covid – low global energy demand | 2020 | 4.1 | -18% |

| Economic rebound leading on to start of energy crisis | 2021 | 9.8 | 136% |

| Peak of crisis due to removal of Russian piped gas | 2022 | 31.9 | 226% |

| “New Normal” relative stability | 2023 | 12.5 | -61% |

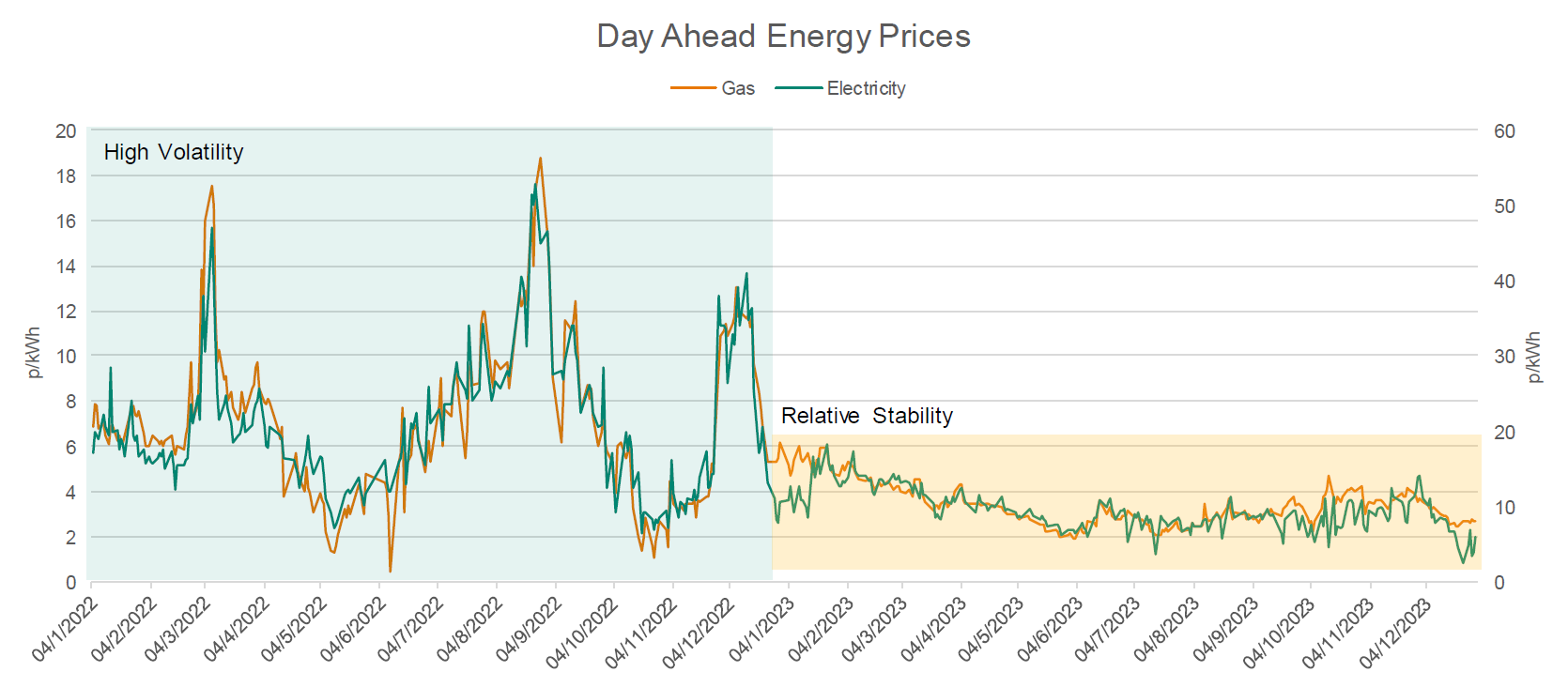

Day Ahead Energy Prices YoY

Day-ahead – at any point in time the price represents the cost of buying energy to be delivered the next working day (e.g., A price today would represent the cost of energy to delivered tomorrow).

Prices from 2023 were significantly higher than pre-energy crisis levels.

Day-ahead energy prices have also moved from extreme volatility in 2022 to relative stability in 2023

Average day ahead gas prices YoY

Average Day-ahead gas prices increased by 190%, comparing 2023 vs. 2019.

| Description | Year | Gas | YoY Difference |

|---|---|---|---|

| Pre-energy Crisis | 2019 | 1.2 | n/a |

| Covid – low global energy demand | 2020 | 0.8 | -29% |

| Economic rebound leading on to start of energy crisis | 2021 | 3.9 | 364% |

| Peak of crisis due to removal of Russian piped gas | 2022 | 7.1 | 82% |

| “New Normal” relative stability | 2023 | 3.4 | -52% |

Average day ahead electricity prices YoY

Year-on-Year day ahead electricity prices were also up 124%.

| Description | Year | Electricity | YoY Difference | |

|---|---|---|---|---|

| Pre-energy Crisis | 2019 | 4.3 | n/a | |

| Covid – low global energy demand | 2020 | 3.6 | -16% | |

| Economic rebound leading on to start of energy crisis | 2021 | 12.3 | 238% | |

| Peak of crisis due to removal of Russian piped gas | 2022 | 20.9 | 71% | |

| “New Normal” relative stability | 2023 | 9.5 | -53% |

Market Outlook

Despite at the start of winter 23 risks being skewed towards the upside, now we are over halfway through the season the outlook is much more positive. Strong supply from Norway with very limited maintenance and a mild start to the season has provided confidence to the market that the winter will be managed comfortably. Even in cold scenarios storage is predicted to be in a good position at the end of winter, reducing bullish pressure on prices in the coming seasons. Geopolitical factors still have the potential to cause market shocks but the increased LNG regasification capacity in Europe has significantly reduced supply security risks in the future.

Downside

- Strong storage position across Europe.

- Even in cold weather scenarios there should be ample supply to comfortably make it through to spring.

- Economic outlook could reinforce lack of demand.

- Any potential for de-escalation in the Middle East.

Upside

- LNG diversion to Asia if their demand ramps up.

- Infrastructure risk or delays (LNG and pipelines).

- Cuts to remaining Russia pipeline supply.

- Demand bounce back from industrial sector.

- Possible further escalation in the Middle East.

Want the best energy and water contracts for your business?

Ginger Energy can help you.

We take the time to understand your needs and handle everything with the supplier on your behalf. Throughout the entire life of your contract, we’re always on hand to help.

Get in touch today to start saving money and time spent on finding the best business energy deals.