As business energy consultants, we are constantly on the lookout for the finest deals on the market for our clients, and we work tirelessly to achieve these. Our monthly market reports provide views directly from our specialists. Use our price analysis, market signals, and political changes to help you make the right choice when it comes to energy decisions.

Download PDFDisclaimer: The information contained in this document has been prepared in good faith by Ginger Energy and provides our views on current/future trends and outcomes, but, as with all forecasts dependent upon multiple, complex variables, there is no certainty whatsoever that our forecasts will turn out to be correct. The information may be based on licenced 3rd party data, publicly available sources, assumptions, and observable market conditions and may change without notice. No warranty, express or implied, is made as to the accuracy, correctness, fitness for purpose, completeness or adequacy of this information nor is it intended to serve as basis for any procurement decision and as such Ginger Energy shall not accept any responsibility or liability for any action taken, financial or otherwise, as a result of this information. Please note that this email is intended for the recipient only and may not be copied, reproduced, or distributed without the prior consent of Ginger Energy.

Market Context

Despite further escalation between Russia and Ukraine and a new raft of sanctions on Russian energy, seasonal prices traded in a narrow range during September. Record high US LNG exports and large amounts of new capacity coming online over the coming years have provided comfort regarding supply even as Europe looks to completely move away from Russian energy sooner than originally planned.

- A new set of sanctions were imposed on Russian energy as news of peace talks diminished and President Trump’s frustrations with President Putin seemingly grew. The EU have stated they will cease buying any Russian energy by January 2027, a year earlier than previously planned.

- Russian attacks targeted energy infrastructure and government buildings in Ukraine and they also breached NATO airspace in Poland.

- Ukraine also upped their offensive, putting close to 20% of Russian oil processing capacity offline with drone strikes.

- Heavy Norwegian maintenance passed without any major disruption or unexpected extensions.

- The end of September marks the end of the summer season where much of the anticipated risk failed to materialize. Ample LNG supplies have allowed a strong storage filling trajectory which has kept prices generally subdued.

- European gas storage inventories are over 82% full and on track to meet targets although they remain well below historical averages.

In other news

- Energy Secretary Ed Miliband has outlined the strategic vision for Great British Energy (GBE), the UK’s publicly-owned clean power company, aimed at strengthening national control over energy supply and shielding billpayers from global fossil fuel price volatility. GBE is being positioned as the UK’s national champion for clean energy, combining investment, innovation, and community engagement to advance the country’s clean power mission while supporting economic growth.

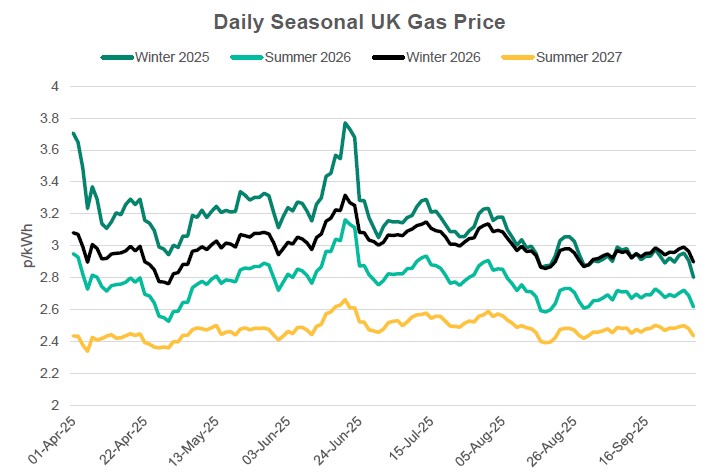

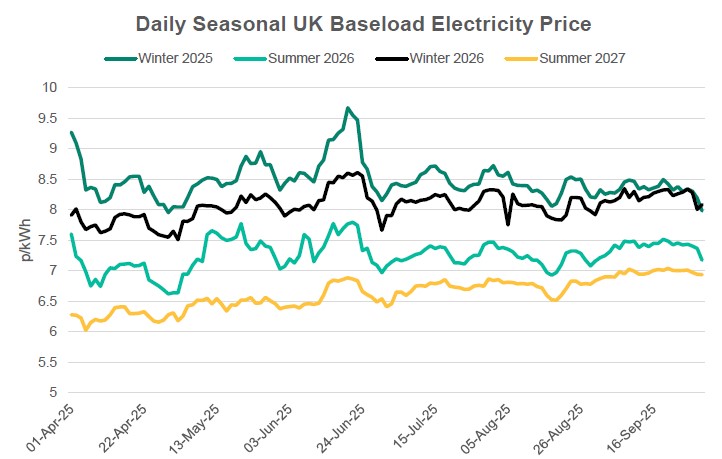

Seasonal Prices

Price Table

September saw curve prices remain stable, trading within a narrow range. They held slightly above the end of August price for most of the month, but the final few days of the summer season saw a small sell-off leading to prices dropping just below the end of August levels.

Month End Energy Only Prices

Spot Prices

| Fuel | September-25 (p/kWh) | August-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.59 | 2.66 | -3% |

| Power (UK Baseload) | 8.19 | 8.25 | -1% |

Front Months

| Fuel | September-25 (p/kWh) | August-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.59 | 2.67 | -3% |

| Power (UK Baseload) | 7.08 | 7.52 | -6% |

Front Season

| Fuel | September-25 (p/kWh) | August-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.80 | 2.88 | -3% |

| Power (UK Baseload) | 7.98 | 8.20 | -3% |

Annual Price (Oct-25)

| Fuel | September-25 (p/kWh) | August-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.74 | 2.80 | -2% |

| Power (UK Baseload) | 7.62 | 7.73 | -1% |

Outlook

As we head into the winter season the outlook is more bearish than at the start of summer. Robust LNG imports into Europe have allowed strong storage injection rates and reduced winter supply concerns. It is expected that the strong LNG exports from the US will continue which should allow Europe to end the winter with much higher storage levels than were forecast earlier in the year. This will reduce pressure on both Summer-26 and Winter-27 prices.

Bearish Signals

- Additional LNG capacity coming online.

- Continued strong US LNG exports.

- Mild start to the winter season.

Bullish Signals

- French strike action could impact LNG arrivals into Europe.

- Early cold snaps which impede further storage injections.

- Increased competition for LNG from China/India.

Want the best energy and water contracts for your business?

Ginger Energy can help you.

We take the time to understand your needs and handle everything with the supplier on your behalf. Throughout the entire life on your contract, we’re always on hand to help. And, there’s obligation to stick with us – you contract directly with the supplier, not with you..

Get in touch today to start saving money and time spent on finding the best business energy deals.