As business energy consultants, we are constantly on the lookout for the finest deals on the market for our clients, and we work tirelessly to achieve these. Our monthly market reports provide views directly from our specialists. Use our price analysis, market signals, and political changes to help you make the right choice when it comes to energy decisions.

Download PDFDisclaimer: The information contained in this document has been prepared in good faith by Ginger Energy and provides our views on current/future trends and outcomes, but, as with all forecasts dependent upon multiple, complex variables, there is no certainty whatsoever that our forecasts will turn out to be correct. The information may be based on licenced 3rd party data, publicly available sources, assumptions, and observable market conditions and may change without notice. No warranty, express or implied, is made as to the accuracy, correctness, fitness for purpose, completeness or adequacy of this information nor is it intended to serve as basis for any procurement decision and as such Ginger Energy shall not accept any responsibility or liability for any action taken, financial or otherwise, as a result of this information. Please note that this email is intended for the recipient only and may not be copied, reproduced, or distributed without the prior consent of Ginger Energy.

Market Context

A relatively mild start to the winter season and ample LNG supply kept upward pressure on prices at bay. These factors helped counter bullish influences due to a lack of progress on peace talks in Ukraine and the EU formalising an exit from buying Russian fuel. As a result, front season prices fell by around 10% when compared to the end of September.

- Peace talks that were meant to take place in Hungary between President Putin and President Trump were indefinitely suspended. Russia are reported to be open to freezing the conflict along current front lines, while President Zelensky is reluctant to concede territory. However, no further formal diplomatic meetings are currently scheduled.

- The EU’s exit from Russian energy was formalised in October overcoming the so called “gas dissidents” Hungary and Slovakia who both depend heavily on Russian oil. Russian gas still represents 12% of the EU’s imports (45% before 2022) and this gas is set to be filled by the US, which is on track to become the world’s largest LNG exporter, with export capacity forecast to rise by 75% by 2030.

- A meeting between Presidents Trump and Xi Jinping concluded with agreements to delay Chinese rare earth controls, in return for US tariffs being trimmed by 10%. The response from markets was muted, after the touted deal ended up as a minor de-escalation in the trade war.

- A ceasefire was agreed in Gaza in the middle of October but both sides have since been accused of breaching the terms of the agreement.

- Storage remains around 83% full and the market view through the month was that anything short of a significantly colder-than-normal winter could be accommodated with current storage levels.

In other news

- The Chair of the Climate Change Committee, an independent, statutory body that advises the UK government on emissions targets and reports on progress towards them, has stated that the Government need to work to reduce electricity prices for consumers to incentivize the move away from fossil fuels. The gap between electricity and gas prices needs to be closed which could be achieved by green levies being shifted from electricity to gas bills or to general, means tested, taxation.

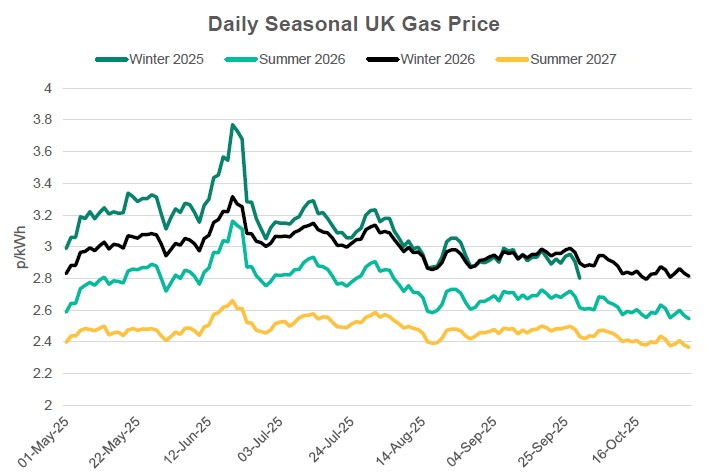

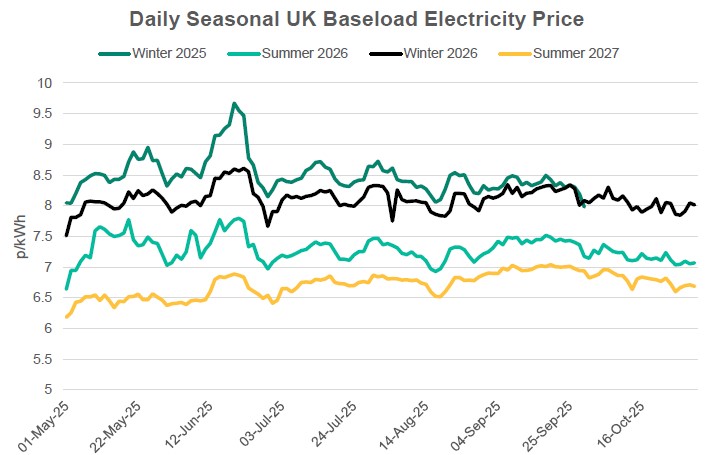

Seasonal Prices

Price Table

Summer 26 prices dropped through October as positive sentiment from expected new LNG capacity outweighed bullish news regarding the EU exiting Russian fuel and a lack of progress with peace talks between Ukraine and Russia. Spot gas prices in October 2025 were the lowest they have been in over a year, since July 2024, but they are still struggling to break the long-standing support level around 2.5 p/kWh.

Month End Energy Only Prices

Spot Prices

| Fuel | October-25 (p/kWh) | September-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.50 | 2.59 | -3% |

| Power (UK Baseload) | 6.27 | 8.19 | -23% |

Front Months

| Fuel | October-25 (p/kWh) | September-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.49 | 2.59 | -4% |

| Power (UK Baseload) | 7.83 | 7.08 | 11% |

Front Season

| Fuel | October-25 (p/kWh) | September-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.55 | 2.80 | -9% |

| Power (UK Baseload) | 7.07 | 7.98 | -11% |

Annual Price (Apr-26)

| Fuel | October-25 (p/kWh) | September-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.73 | 2.74 | 0% |

| Power (UK Baseload) | 7.59 | 7.62 | 0% |

Outlook

The winter outlook has turned slightly bullish as weather forecasts indicate a colder winter than last year. Cold scenarios could see storage drop to record lows. However, projections suggest in all but extreme cold scenarios storage could be refilled to over 95% by next winter due to new LNG supply availability. If storage levels do reach historic lows the market is likely to react bullishly despite the positive supply predictions for next year.

Bearish Signals

- Additional LNG capacity coming online.

- Continued weak industrial demand especially in energy intensive industries in Germany.

- Milder than currently expected weather.

Bullish Signals

- Any delays to new LNG projects coming online.

- Increased demand from Ukraine as energy infrastructure continues to come under attack.

- Positive trade talks which improve the macro-economic outlook and increase energy demand forecasts.

Want the best energy and water contracts for your business?

Get in touch today to start saving money and time spent on finding the best business energy deals.