As business energy consultants, we always have our finger on the pulse, working tireless to help our customers get the best deal on the market. These monthly market reports give you insights directly from our experts. Use our price analysis, market signals, and political changes to help you make the right choice when it comes to your energy.

Download PDFDisclaimer: The information contained in this document has been prepared in good faith by Ginger Energy and provides our views on current/future trends and outcomes, but, as with all forecasts dependent upon multiple, complex variables, there is no certainty whatsoever that our forecasts will turn out to be correct. The information may be based on licenced 3rd party data, publicly available sources, assumptions, and observable market conditions and may change without notice. No warranty, express or implied, is made as to the accuracy, correctness, fitness for purpose, completeness or adequacy of this information nor is it intended to serve as basis for any procurement decision and as such Ginger Energy shall not accept any responsibility or liability for any action taken, financial or otherwise, as a result of this information. Please note that this email is intended for the recipient only and may not be copied, reproduced, or distributed without the prior consent of Ginger Energy.

Market Context

October witnessed a return to high volatility after a period of relative calm. The lows of the start of the month were quickly followed by rapid increases off the back of the Hamas attacks on 7th October which were followed by the ongoing Israeli response. Geopolitics has dominated price direction, rendering market fundamentals minor players.

- Israeli response to the Hamas attacks has created a large amount of unrest in the Middle East, sparking fears of a wider conflict which could impact global oil and gas markets.

- Israel shut down Tamar gas field which impacted exports to Egypt which in turn reduced Egypt’s exports of LNG.

- Threats of strikes at Australian LNG plants continue to rumble on but Chevron are committed to resolving the issues and reaching a deal.

- An undersea gas pipe connecting Estonia to Finland (Balticonnector) was damaged. Investigations have confirmed an anchor from a Chinese registered vessel was to blame but authorities are still unsure if the damage was accidental or deliberate.

- LNG flows to Europe were strong this month.

- Total EU gas storage has passed the 99% mark and reached higher levels than any point in the last 5 years.

In other news

Wind power now has the largest capacity of any power generation type in the UK. The wind fleet has reached 29 GW of installed capacity, recently overtaking combined cycle gas power stations. The capacity includes an almost 50/50 split of onshore and offshore farms.

This makes Britain only the 5th country in the world to have built more wind farms than any other type of power station.

There is a vast 98 GW of capacity in the pipeline, the second largest in the world (only behind China).

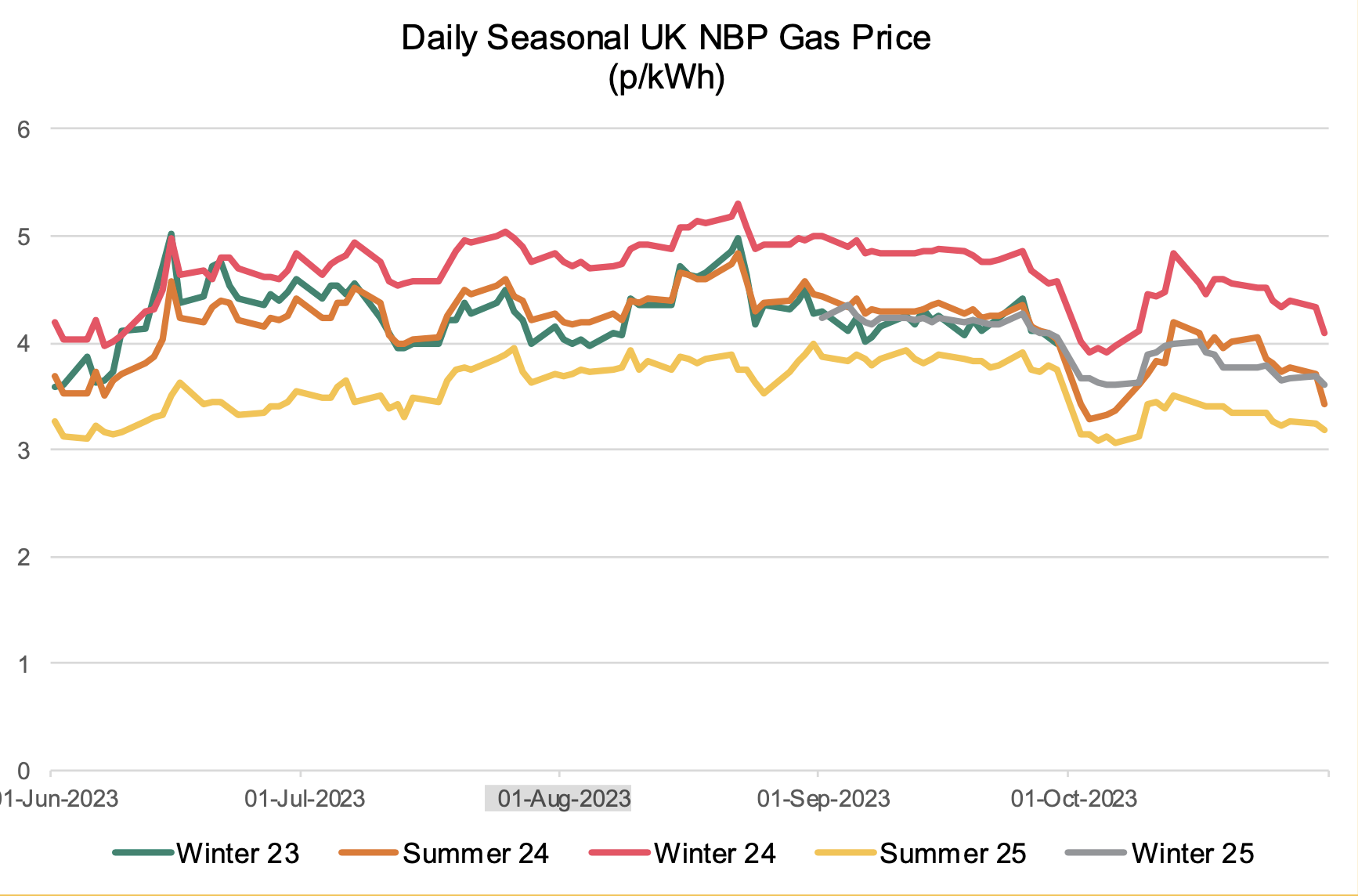

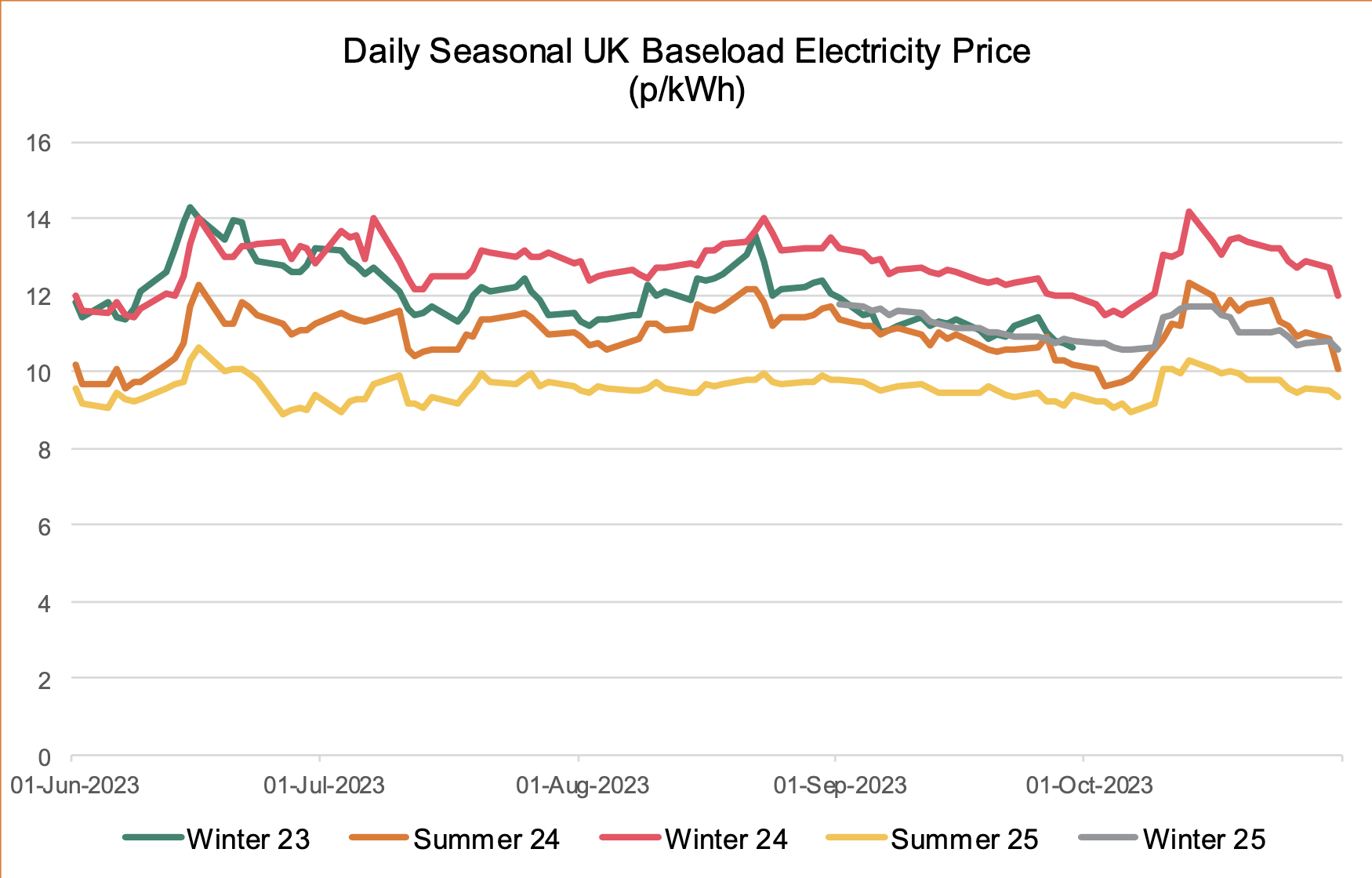

Seasonal Prices

Price Table

Throughout the month prices for some contracts increased by as much as 50% before retracing most of the gains by the end of the month. Front Month prices ended October showing the largest increase, but this is partly a reflection of edging further into the Winter ‘23 season.

Month End Prices

Spot Prices

| Fuel | Oct-23 (p/kWh) | Sep-23 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.48 | 3.23 | 8% |

| Power (UK Baseload) | 7.65 | 8.82 | -13% |

Front Months

| Fuel | Oct-23 (p/kWh) | Sepg-23 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.77 | 3.29 | 27% |

| Power (UK Baseload) | 10.72 | 8.70 | 23% |

Front Season

| Fuel | Oct-23 (p/kWh) | Sep-23 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 4.15 | 3.98 | 4% |

| Power (UK Baseload) | 10.07 | 10.62 | -5% |

Annual Price (Oct-23)

| Fuel | Oct-23 (p/kWh) | Sep-23 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 4.60 | 4.00 | 15% |

| Power (UK Baseload) | 11.13 | 10.43 | 7% |

Historical Comparison

| Fuel | 2019 Average Front Season Price (p/kWh) | % Increase to Oct-23 |

|---|---|---|

| Gas (NBP) | 1.64 | 154% |

| Power (UK Baseload) | 5.10 | 97% |

Outlook

The positive fundamental outlook continues to take a backseat to geopolitical drivers. Where the market goes in the short term is going to be hugely dependent on how things unfold in the Middle East.

Throughout the winter season risks are skewed towards upside with volatility likely to stick around.

Bearish Signals

- Any sort of de-escalation of the conflict.

- NWE gas storage over 99% full.

- Increased LNG arrivals scheduled.

- Weather forecasts have adjusted milder for short/medium term.

- Demand destruction in the industrial sector is set to continue.

Bullish Signals

- Any sort of escalation of the conflict.

- Risk of cold winter weather becomes a factor.

- Growth in Asian LNG demand.

- Unplanned outages or disruption to supply infrastructure.

- Global demand bounces back.

Want the best energy and water contracts for your business?

Ginger Energy can help you.

We take the time to understand your needs and handle everything with the supplier on your behalf. Throughout the entire life on your contract, we’re always on hand to help. And, there’s obligation to stick with us – you contract directly with the supplier, not with you.

Get in touch today to start saving money and time spent on finding the best business energy deals.