As business energy consultants, we are constantly on the lookout for the finest deals on the market for our clients, and we work tirelessly to achieve these. Our monthly market reports provide views directly from our specialists. Use our price analysis, market signals, and political changes to help you make the right choice when it comes to energy decisions.

Download PDFDisclaimer: The information contained in this document has been prepared in good faith by Ginger Energy and provides our views on current/future trends and outcomes, but, as with all forecasts dependent upon multiple, complex variables, there is no certainty whatsoever that our forecasts will turn out to be correct. The information may be based on licenced 3rd party data, publicly available sources, assumptions, and observable market conditions and may change without notice. No warranty, express or implied, is made as to the accuracy, correctness, fitness for purpose, completeness or adequacy of this information nor is it intended to serve as basis for any procurement decision and as such Ginger Energy shall not accept any responsibility or liability for any action taken, financial or otherwise, as a result of this information. Please note that this email is intended for the recipient only and may not be copied, reproduced, or distributed without the prior consent of Ginger Energy.

Market Context

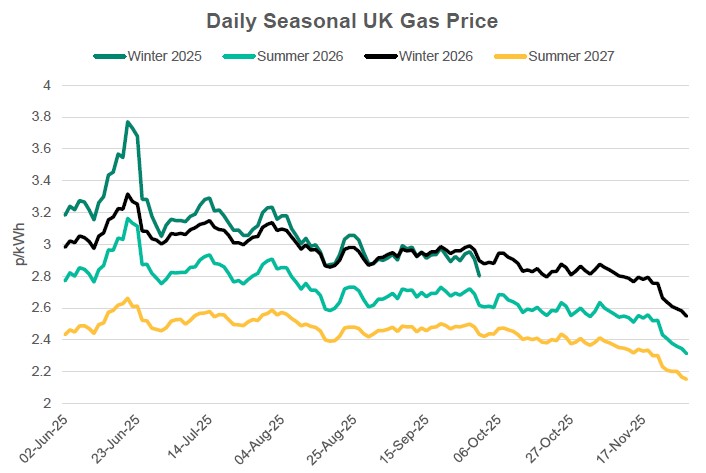

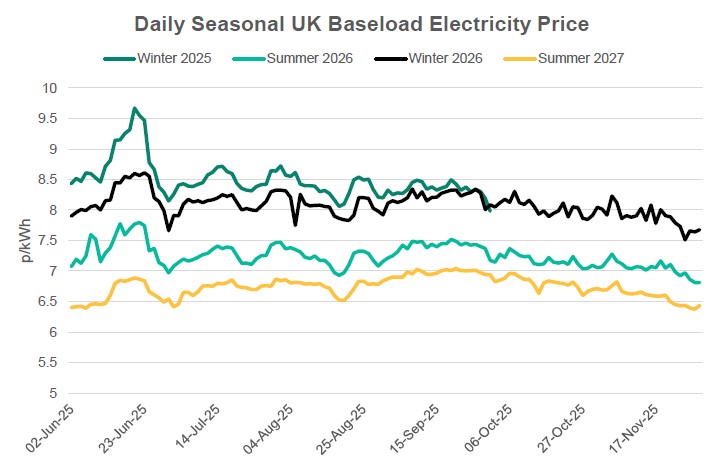

For seasonal energy prices, November was a month of two halves. The first saw a clear continuation of the recent sideways momentum with cold weather and forecasts skewing future risk to the upside. However, once the US released their peace plan, and diplomatic efforts to end the conflict in Ukraine accelerated, prices fell sharply. Front season gas contracts ended the month almost 10% down on the end of October.

- The US released a 28-point peace plan to end the conflict in Ukraine which resulted in seasonal gas prices falling considerably over the last week of the month.

- The market reacted positively to a potential peace deal, but some people believe there are significant obstacles to securing a settlement including agreeing specifics regarding Ukrainian territory concessions and future security guarantees.

- On the ground fighting between Russia and Ukraine continued to intensify with energy infrastructure heavily targeted creating potential security of supply worries for Ukraine which could spread into wider Europe.

- Prompt markets reacted strongly bullish to the cold spell that hit the UK mid-November, but they have since retreated closer to the 3-month average with milder temperatures curbing demand.

- EU aggregated storage began to deplete more rapidly and at the end of November inventories were around 76% vs a 5-year average of 87% however, robust LNG supply has been curtailing withdrawals.

- Winter risk through November 25 was viewed a lot lower than at the same time last year. December contracts in November 24 were significantly higher despite the 90% storage levels.

In other news

- The Government announced plans to reduce household energy bills by around £150 by moving 75% of the cost of the Renewables Obligation to general taxation and scrapping the Energy Company Obligation (ECO). The ECO scheme forced energy companies to pay for measures like insulation and heating systems for low-income households, but the scheme came under scrutiny last month when the National audit office warned of potential fraud and poor-quality work being carried out under the program. The reduction will come into effect from Apr-26.

Seasonal Prices

Price Table

At the end of November both spot and front month prices are demonstrating the shift into the winter season with overall demand increasing and putting upward pressure on prices. Further out, seasonal and annual prices fell on the backdrop of revived diplomatic efforts to bring an end to the war in Ukraine. Gas prices are currently seeing the largest reductions.

Month End Energy Only Prices

Spot Prices

| Fuel | November-25 (p/kWh) | October-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.57 | 2.50 | 3% |

| Power (UK Baseload) | 7.90 | 6.27 | 26% |

Front Months

| Fuel | November-25 (p/kWh) | October-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.55 | 2.49 | 2% |

| Power (UK Baseload) | 8.06 | 7.83 | 3% |

Front Season

| Fuel | November-25 (p/kWh) | October-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.31 | 2.55 | -9% |

| Power (UK Baseload) | 6.81 | 7.07 | -4% |

Annual Price (Apr-26)

| Fuel | November-25 (p/kWh) | October-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.48 | 2.73 | -9% |

| Power (UK Baseload) | 7.29 | 7.59 | -4% |

Outlook

The fundamental supply and demand balance is liable to take a backseat to geopolitical developments as market direction is likely to be closely tied to the success of the peace negotiations between Ukraine and Russia. Currently weather forecasts for December look to be mild which will help keep prices subdued. However, storage remains far lower than in previous years and a heavy reliance on LNG throughout the winter could pose upside risk.

Bearish Signals

- Potential for peace between Ukraine and Russia.

- Continued strong LNG flows to Europe.

- Mild winter temperatures currently expected for early December.

Bullish Signals

- If peace negotiations lose momentum.

- Possible LNG infrastructure or supply issues.

- Longer term weather forecasts suggest it could be a cold winter for Europe.

Want the best energy and water contracts for your business?

Get in touch today to start saving money and time spent on finding the best business energy deals.