As business energy consultants, we are constantly on the lookout for the finest deals on the market for our clients, and we work tirelessly to achieve these. Our monthly market reports provide views directly from our specialists. Use our price analysis, market signals, and political changes to help you make the right choice when it comes to energy decisions.

Download PDFDisclaimer: The information contained in this document has been prepared in good faith by Ginger Energy and provides our views on current/future trends and outcomes, but, as with all forecasts dependent upon multiple, complex variables, there is no certainty whatsoever that our forecasts will turn out to be correct. The information may be based on licenced 3rd party data, publicly available sources, assumptions, and observable market conditions and may change without notice. No warranty, express or implied, is made as to the accuracy, correctness, fitness for purpose, completeness or adequacy of this information nor is it intended to serve as basis for any procurement decision and as such Ginger Energy shall not accept any responsibility or liability for any action taken, financial or otherwise, as a result of this information. Please note that this email is intended for the recipient only and may not be copied, reproduced, or distributed without the prior consent of Ginger Energy.

Market Context

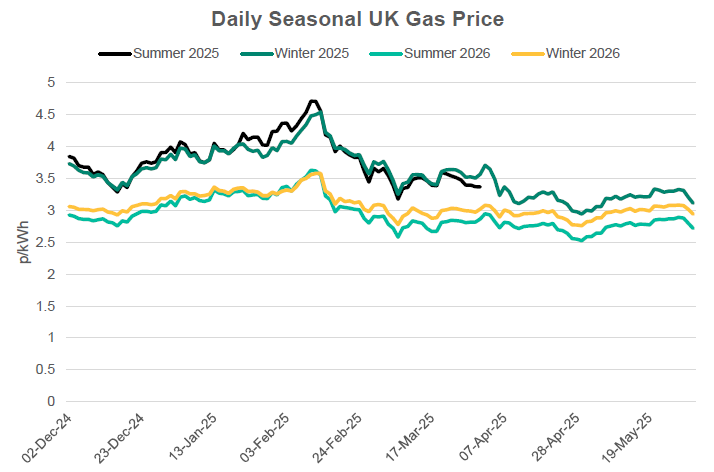

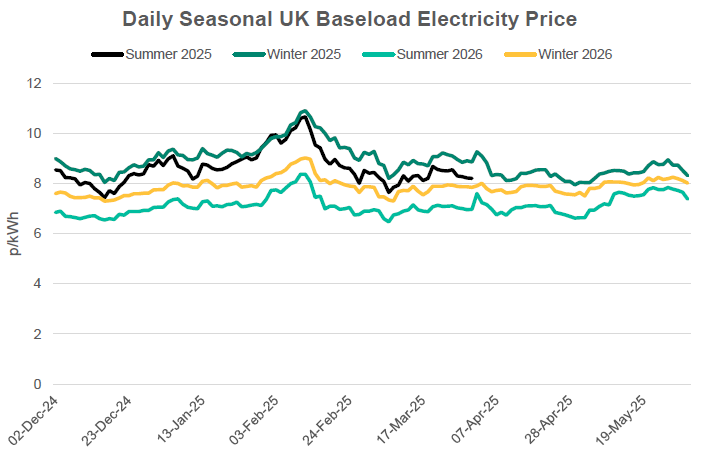

Throughout May seasonal prices steadily climbed rising almost 10% on the backdrop of heavy Norwegian maintenance and geopolitical instability. However, the sunniest spring on record and warm temperatures helped keep storage injections going at a strong rate and by the end of the month around 5% of the gains had been retraced.

- Peace talks continued but there has still been no meaningful progress. It has become clear that Russia’s expectations are that five areas of Ukraine would become internationally recognised as Russia and that Ukraine would remain a neutral state not hosting any foreign military. Throughout the month fighting continued.

- Tensions between India and Pakistan were high as they exchanged missile attacks early in the month before agreeing to cease hostilities.

- The UK agreed trade deals with US, EU, and India.

- Global recession fears were alleviated slightly as President Trump agreed trade deals with many nations but tensions with China were still evident.

- Aggregated EU storage targets were reduced to 83% from 90% and the window for hitting the mandated target was extended through to 1st December from 1st November.

- EU aggregated gas storage started being filled at a good rate and is now around 35% full. The current trajectory is in line with 2022 when a strong injection season saw comfortable storage levels reached to manage the winter.

- Warm settled weather continued through most of May ending in the sunniest spring on record.

- The storage outlook improved with European stocks reaching close to 50% as the warm sunny start to the season allowed for injections at a good rate. Increased LNG flows also supported ample injections.

In other news

- Ofgem have announced the latest domestic price cap to take affect from 01/07/2025. The new prices represent a 7% decrease when compared to the previous with a drop in wholesale prices over the assessment period being the main driver for the reduction.

- Electricity = 25.73p/kWh / 51.37p/day

Gas = 6.33p/kWh / 29.82p/day

Seasonal Prices

Price Table

Prices across the curve rose steadily through May with a small retracement evident in the closing few days. Day-ahead power prices saw a large decline as strong winds and sunny weather led to strong renewable generation.

Month End Energy Only Prices

Spot Prices

| Fuel | May-25 (p/kWh) | Apr-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.70 | 2.59 | 4% |

| Power (UK Baseload) | 5.95 | 7.50 | -32% |

Front Months

| Fuel | Apr-25 (p/kWh) | Mar-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.85 | 2.64 | 19% |

| Power (UK Baseload) | 7.03 | 7.00 | 0% |

Front Season

| Fuel | May-25 (p/kWh) | Apr-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.11 | 3.00 | 4% |

| Power (UK Baseload) | 8.32 | 8.05 | 3% |

Annual Price (Apr-25)

| Fuel | May-25 (p/kWh) | Apr-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.99 | 2.88 | 4% |

| Power (UK Baseload) | 7.90 | 7.41 | 7% |

Historical Comparison

| Fuel | 2019 Average Front Season Price (p/kWh) | % Increase to May-25 |

|---|---|---|

| Gas (NBP) | 1.64 | 90% |

| Power (UK Baseload) | 5.10 | 63% |

Outlook

Many analyst now believe in all but a very cold weather scenario it is expected that ample storage levels will be reached to manage the next winter season. A reduction in German industrial demand through April and May and lower exports from the EU have helped alleviate some of the risk but heavy maintenance continues to pose a threat to the injection trajectory as we move through the summer.

Bearish Signals

- Potential positive outcome to Russia/Ukraine peace talks.

- Drop in residential and industrial demand.

- Continued strong injection rate.

Bullish Signals

- Lower LNG supply to NWE in June compared to May

- Heavier UK maintenance.

Want the best energy and water contracts for your business?

Ginger Energy can help you.

We take the time to understand your needs and handle everything with the supplier on your behalf. Throughout the entire life on your contract, we’re always on hand to help. And, there’s obligation to stick with us – you contract directly with the supplier, not with you..

Get in touch today to start saving money and time spent on finding the best business energy deals.