As business energy consultants, we are constantly on the lookout for the finest deals on the market for our clients, and we work tirelessly to achieve these. Our monthly market reports provide views directly from our specialists. Use our price analysis, market signals, and political changes to help you make the right choice when it comes to energy decisions.

Download PDFDisclaimer: The information contained in this document has been prepared in good faith by Ginger Energy and provides our views on current/future trends and outcomes, but, as with all forecasts dependent upon multiple, complex variables, there is no certainty whatsoever that our forecasts will turn out to be correct. The information may be based on licenced 3rd party data, publicly available sources, assumptions, and observable market conditions and may change without notice. No warranty, express or implied, is made as to the accuracy, correctness, fitness for purpose, completeness or adequacy of this information nor is it intended to serve as basis for any procurement decision and as such Ginger Energy shall not accept any responsibility or liability for any action taken, financial or otherwise, as a result of this information. Please note that this email is intended for the recipient only and may not be copied, reproduced, or distributed without the prior consent of Ginger Energy.

Market Context

June was an extremely volatile month with price movement dominated by geopolitical events in the Middle East. Front season gas prices rose around 10% as tensions ratcheted up between Iran, Israel & the US. However, all of the value was lost in a single session once the ceasefire was announced, despite its shaky start.

- On the 13th June, Israel launched attacks on Iran to which Iran responded. The two sides then exchanged missile fire and drone attacks for several days.

- Markets rose sharply on the risk that oil and LNG supplies that pass through the Strait of Hormuz could be impacted by the conflict. Around one-fifth of global supplies pass-through the Strait so any disruption would cause a tightening of the global supply and demand balance.

- The US then launched a covert attack to destroy Iran’s nuclear weapon making capability, but it is yet to be confirmed to what extent they were able to achieve their aims.

- A response that many believed was performative was carried out by Iran as they launched attacks on US Military bases in the region.

- Shortly after a ceasefire was announced which had a shaky start as Israel immediately accused Iran of breaking the agreement. However, it held, and markets responded bearishly retracing all the recent gains in a single trading session.

- Warm settled weather continued with the lack of wind generation creating high short term power prices.

- European storage levels ended the month just shy of 60% full against a five-year average of 65%.

In other news

- The Government have stepped in to protect consumers with old energy meters.

- A widespread switch-off of Radio Teleswitch Service (RTS) meters did not happen on 30th June as scheduled. Instead, the date will mark the start of a phase-out process with small numbers of homes and businesses in specific areas being targeted to ensure the process is smooth and working families are protected.

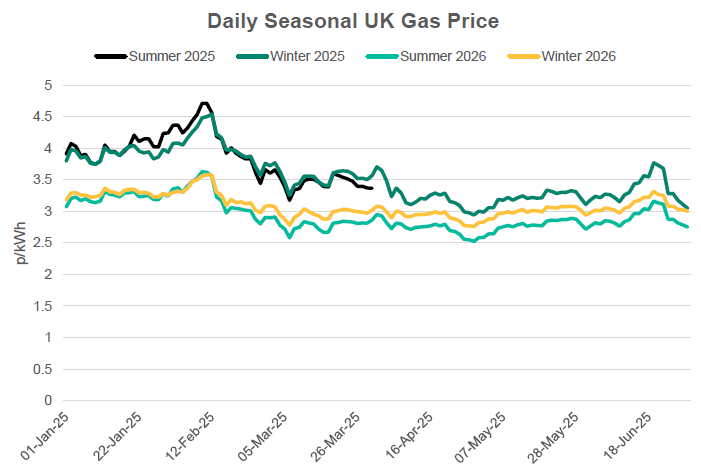

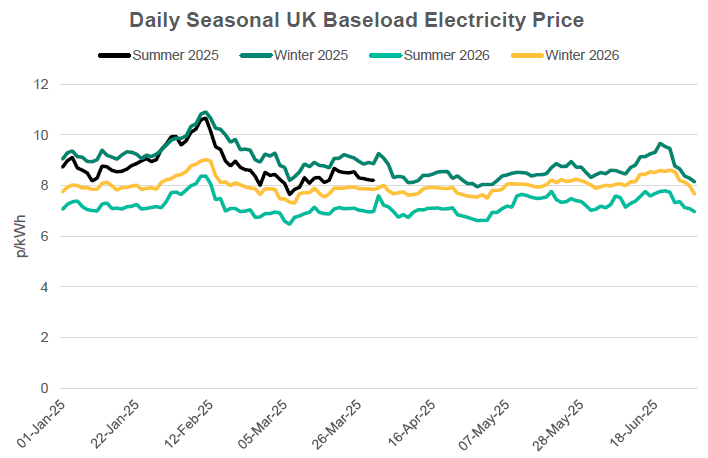

Seasonal Prices

Price Table

After the sharp rises early in the month, most prices down the curve ended up roughly level to where they finished last month. Spot power prices saw a large increase due to reduced renewable generation off the back of low wind speeds towards the end of the month.

Month End Energy Only Prices

Spot Prices

| Fuel | June-25 (p/kWh) | May-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.61 | 2.70 | -3% |

| Power (UK Baseload) | 9.1 | 5.95 | 53% |

Front Months

| Fuel | June-25 (p/kWh) | May-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.63 | 2.85 | -8% |

| Power (UK Baseload) | 7.08 | 7.03 | 1% |

Front Season

| Fuel | June-25 (p/kWh) | May-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.05 | 3.11 | -2% |

| Power (UK Baseload) | 8.15 | 8.32 | -2% |

Annual Price (Oct-25)

| Fuel | June-25 (p/kWh) | May-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.96 | 2.99 | -1% |

| Power (UK Baseload) | 7.62 | 7.74 | -2% |

Historical Comparison

| Fuel | 2019 Average Front Season Price (p/kWh) | % Increase to June-25 |

|---|---|---|

| Gas (NBP) | 1.64 | 86% |

| Power (UK Baseload) | 5.10 | 60% |

Outlook

Limited maintenance in Norway during July is forecast to lead to a comfortable supply position throughout the upcoming month. The current projections suggest that in most scenarios European storage will be adequately filled heading into Winter ‘25. As a result, prices over the coming months are likely to stabilise but geopolitical escalations or macro-economic risks remain present.

Bearish Signals

- Low Norwegian maintenance scheduled for July.

- Further calming of situation in the Middle East.

- Continued strong storage injections.

Bullish Signals

- Any reoccurrence of tensions in Middle East

- Any increase in Asian demand for LNG which is currently low vs last year.

Want the best energy and water contracts for your business?

Ginger Energy can help you.

We take the time to understand your needs and handle everything with the supplier on your behalf. Throughout the entire life on your contract, we’re always on hand to help. And, there’s obligation to stick with us – you contract directly with the supplier, not with you..

Get in touch today to start saving money and time spent on finding the best business energy deals.