As business energy consultants, we are constantly on the lookout for the finest deals on the market for our clients, and we work tirelessly to achieve these. Our monthly market reports provide views directly from our specialists. Use our price analysis, market signals, and political changes to help you make the right choice when it comes to energy decisions.

Download PDFDisclaimer: The information contained in this document has been prepared in good faith by Ginger Energy and provides our views on current/future trends and outcomes, but, as with all forecasts dependent upon multiple, complex variables, there is no certainty whatsoever that our forecasts will turn out to be correct. The information may be based on licenced 3rd party data, publicly available sources, assumptions, and observable market conditions and may change without notice. No warranty, express or implied, is made as to the accuracy, correctness, fitness for purpose, completeness or adequacy of this information nor is it intended to serve as basis for any procurement decision and as such Ginger Energy shall not accept any responsibility or liability for any action taken, financial or otherwise, as a result of this information. Please note that this email is intended for the recipient only and may not be copied, reproduced, or distributed without the prior consent of Ginger Energy.

Market Context

June has been a relatively stable month, especially after the first trading week. The market is struggling to find a direction with a fairly positive fundamentals outlook being slightly offset with high global demand for LNG. Front season gas prices ended the month 1% lower than the end of May and traded within a narrow range for the last 3-weeks of the month.

- Outages at large processing plants in Norway early in the month were resolved relatively quickly.

- Warm weather in Asia created increased competition for LNG resulting in limited cargoes reaching Europe through June.

- Attacks by Russia are continuing to threaten Ukrainian energy infrastructure.

- Further EU sanctions on Russia were imposed, as expected, and have had limited impact on market. The sanctions prevent the resale of Russian LNG from European ports rather than restricting Russian LNG use within Europe.

- Cool weather for large parts of June were followed by a short heatwave towards the end of the month.

- Storage across Europe is currently at 76% vs a 5-year average of 67%.

In other news

- The UK has achieved the status as the first major economy to halve greenhouse gas emissions and tops the global decarbonisation league table.

- Drops in electricity emissions have been the main contributor and the reductions have been achieved by the phasing out of coal and increasing renewable generation. The shift away from energy intensive manufacturing in the UK has also caused significant reductions in the industrial sector.

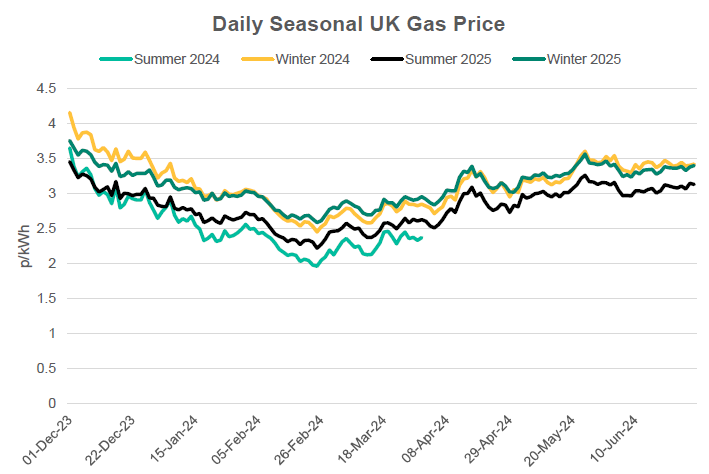

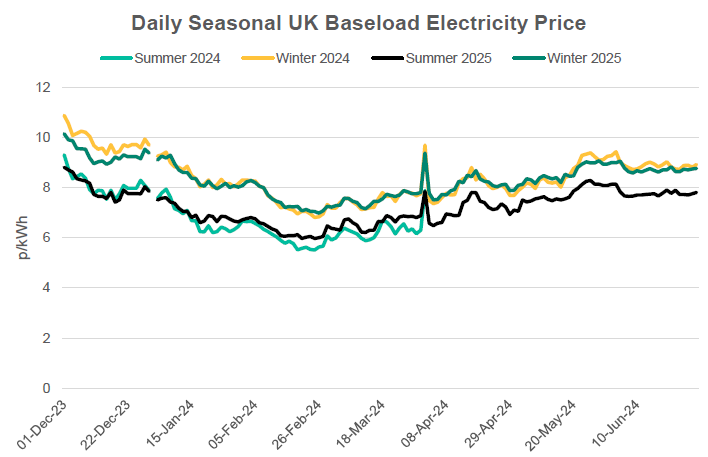

Seasonal Prices

Price Table

Prices remained fairly level across the curve with most prices seeing marginal losses apart from front month gas and the ever-volatile daily power price. The small changes demonstrate the markets current phase of relative stability.

Month End Prices

Spot Prices

| Fuel | June-24 (p/kWh) | May-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.72 | 2.81 | -3% |

| Power (UK Baseload) | 7.52 | 5.70 | 32% |

Front Months

| Fuel | June-24 (p/kWh) | May-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.72 | 2.80 | 5% |

| Power (UK Baseload) | 7.26 | 7.56 | -4% |

Front Season

| Fuel | June-24 (p/kWh) | May-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.42 | 3.47 | -1% |

| Power (UK Baseload) | 8.92 | 9.27 | -4% |

Annual Price (Oct-23)

| Fuel | June-24 (p/kWh) | May-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.33 | 3.36 | -1% |

| Power (UK Baseload) | 8.41 | 8.76 | -4% |

Historical Comparison

| Fuel | 2019 Average Front Season Price (p/kWh) | % Increase to June-24 |

|---|---|---|

| Gas (NBP) | 1.64 | 109% |

| Power (UK Baseload) | 5.10 | 75% |

Outlook

Global geopolitical concerns continue to hang in the air and combined with unforeseen outages at LNG or natural gas processing plants and high global LNG demand, remain the key risks in the market. High storage and low demand continue to drive the overall positive fundamentals outlook.

Bearish Signals

- Storage close to record levels.

- Soft residential and gas-for-power consumption combined with continued demand destruction in industrial sectors.

- Strong Norwegian output.

Bullish Signals

- Unplanned maintenance at LNG terminals which may limit global supply.

- Norwegian maintenance extensions or unplanned events that impact gas flows from Norway.

- Geopolitical landscape in Russian/Ukraine and the Middle East.

Want the best energy and water contracts for your business?

Ginger Energy can help you.

We take the time to understand your needs and handle everything with the supplier on your behalf. Throughout the entire life on your contract, we’re always on hand to help. And, there’s obligation to stick with us – you contract directly with the supplier, not with you..

Get in touch today to start saving money and time spent on finding the best business energy deals.