As business energy consultants, we are constantly on the lookout for the finest deals on the market for our clients, and we work tirelessly to achieve these. Our monthly market reports provide views directly from our specialists. Use our price analysis, market signals, and political changes to help you make the right choice when it comes to energy decisions.

Download PDFDisclaimer: The information contained in this document has been prepared in good faith by Ginger Energy and provides our views on current/future trends and outcomes, but, as with all forecasts dependent upon multiple, complex variables, there is no certainty whatsoever that our forecasts will turn out to be correct. The information may be based on licenced 3rd party data, publicly available sources, assumptions, and observable market conditions and may change without notice. No warranty, express or implied, is made as to the accuracy, correctness, fitness for purpose, completeness or adequacy of this information nor is it intended to serve as basis for any procurement decision and as such Ginger Energy shall not accept any responsibility or liability for any action taken, financial or otherwise, as a result of this information. Please note that this email is intended for the recipient only and may not be copied, reproduced, or distributed without the prior consent of Ginger Energy.

Market Context

July was a quieter month when compared with the large volatility witnessed during June. Generally, seasonal prices ended the month slightly up from the end of June with US Presidential policy announcements again driving market sentiment as the fundamentals remained largely stable.

- US threatened further sanctions on Russian oil to pressure President Putin to bring an end to the war. Meanwhile attacks persisted from both sides throughout the month.

- President Trump’s trade war continued to keep the market on edge. With some deals being made and extensions to deadlines creating further uncertainty for the macro-economic outlook.

- The EU agreed a trade deal with the US based on tariffs of 15% for most items, a reduction from the 30% that was in place. In turn the EU committed to buying huge amounts of LNG from the US.

- LNG demand increased in Asia and Egypt squeezing global demand. Competition was evident as tankers changed direction in the water diverting towards the highest bidder.

- Temperatures across the UK and Europe subsided which reduced near-term cooling demand.

- European storage levels grew substantially during the first half of the injection season and ended July at 68%. The coming months are set to be critical in getting Europe ready for the winter heating season.

In other news

- During July, the government announced an extension to the Contract for Difference scheme, a subsidy scheme which is in place to drive investment in green energy. The contract duration has been raised from 15 to 20 years with the government arguing that spreading the cost over a longer period would lower financing costs for developers. The decision has raised concerns over renewable energy projects receiving state support for longer than envisaged which could increase energy bills long into the future.

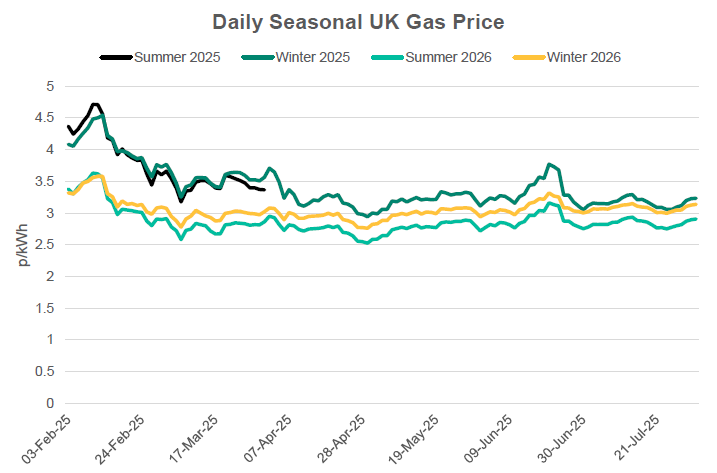

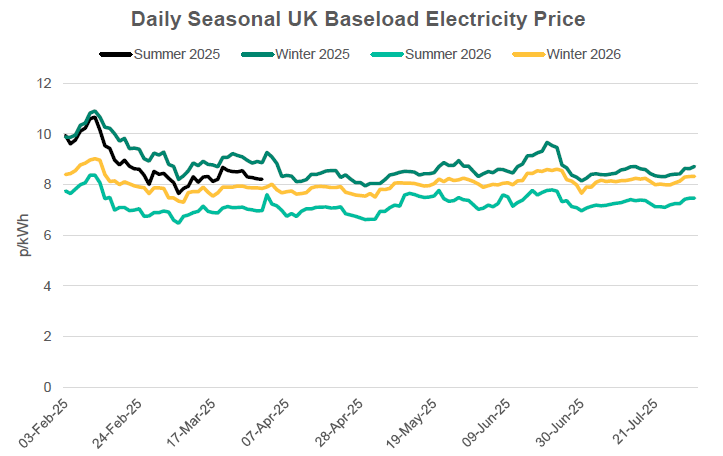

Seasonal Prices

Price Table

Except for spot power prices, all prices down the curve rose slightly month-on-month. There was little to drive any large directional shifts, but seasonal gas prices found resistance at around 3p/kWh a level which they have struggled to breach for some time now.

Month End Energy Only Prices

Spot Prices

| Fuel | July-25 (p/kWh) | June-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.84 | 2.61 | 9% |

| Power (UK Baseload) | 8.23 | 9.1 | -10% |

Front Months

| Fuel | July-25 (p/kWh) | June-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.85 | 2.63 | 8% |

| Power (UK Baseload) | 7.74 | 7.08 | 9% |

Front Season

| Fuel | July-25 (p/kWh) | June-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.23 | 3.05 | 6% |

| Power (UK Baseload) | 8.72 | 8.15 | 7% |

Annual Price (Oct-25)

| Fuel | July-25 (p/kWh) | June-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.14 | 2.96 | 6% |

| Power (UK Baseload) | 8.16 | 7.62 | 7% |

Outlook

Norwegian maintenance is planned to increase substantially throughout August which will impact European supply. Also, storage filling forecasts have been reduced due to lower-than-expected LNG supply from August through to October. These two things provide a slight bullish slant to the market, but geopolitical and macro-economic factors are likely to continue to impact price direction.

Bearish Signals

- Lower temperatures across Europe reducing cooling demand.

- Possible progress on peace in Ukraine.

- Any tariff developments that lead to a weak macro-economic outlook.

Bullish Signals

- Heavy Norwegian maintenance set to reduce storage injection rate.

- Continued LNG competition.

- Any tariff developments that lead to a more positive macro-economic outlook.

Want the best energy and water contracts for your business?

Ginger Energy can help you.

We take the time to understand your needs and handle everything with the supplier on your behalf. Throughout the entire life on your contract, we’re always on hand to help. And, there’s obligation to stick with us – you contract directly with the supplier, not with you..

Get in touch today to start saving money and time spent on finding the best business energy deals.