As business energy consultants, we are constantly on the lookout for the finest deals on the market for our clients, and we work tirelessly to achieve these. Our monthly market reports provide views directly from our specialists. Use our price analysis, market signals, and political changes to help you make the right choice when it comes to energy decisions.

Download PDFDisclaimer: The information contained in this document has been prepared in good faith by Ginger Energy and provides our views on current/future trends and outcomes, but, as with all forecasts dependent upon multiple, complex variables, there is no certainty whatsoever that our forecasts will turn out to be correct. The information may be based on licenced 3rd party data, publicly available sources, assumptions, and observable market conditions and may change without notice. No warranty, express or implied, is made as to the accuracy, correctness, fitness for purpose, completeness or adequacy of this information nor is it intended to serve as basis for any procurement decision and as such Ginger Energy shall not accept any responsibility or liability for any action taken, financial or otherwise, as a result of this information. Please note that this email is intended for the recipient only and may not be copied, reproduced, or distributed without the prior consent of Ginger Energy.

Market Context

January was a very volatile month which saw the new President inaugurated, a cease fire agreed in Gaza, and further attacks on energy infrastructure in Europe. The cold, calm weather forced UK power prices to extreme levels for short periods. Front season gas prices ended the month 10% higher than the start of January as pressure continues to mount due to diminishing gas storage levels across Northwest Europe.

- Cold weather with little wind created a tight supply demand balance across the UK which pushed intra day power prices to extremely high levels.

- There was news of a thwarted attack on the Turkstream pipeline which takes gas from Russia towards Turkey which pushed prices up in the middle of the month. This was followed by two drone attacks on Russian Oil refineries, both claimed by Ukraine.

- Conversations continued regarding restarting gas transit from Russia through Ukraine with pressure being exerted by Hungarian Prime Minister to get gas flowing again.

- President Trump signed Executive Orders that include releasing more fossil fuels for global export and removing America from the Paris Agreement within hours of his inauguration.

- A ceasefire was agreed in Gaza, hostages from both sides were released but the violence did not completely stop as Israel continued with targeted attacks.

- Storage withdrawals continued through January with Northwest European inventories now less than half full. They are now significantly lower than the last two years, which were the first without large amounts of Russian piped gas being available to refill storage during the summer months.

- Colder weather forecasts also drove prices up with fears of further diminishing storage. Ending winter with low storage is putting pressure on summer 25 prices. They are currently higher than winter 25 prices which would make filling storage economically hard to justify.

In other news

- In other news President Trump has announced trade tariffs on Canada, Mexico, and China and has said the EU will “definitely” be next. This is negatively impacting the share price of many companies with European car manufacturers expected to be hardest hit.

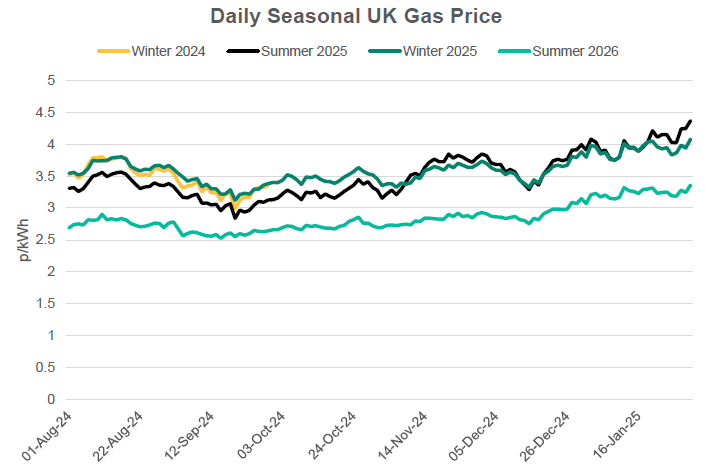

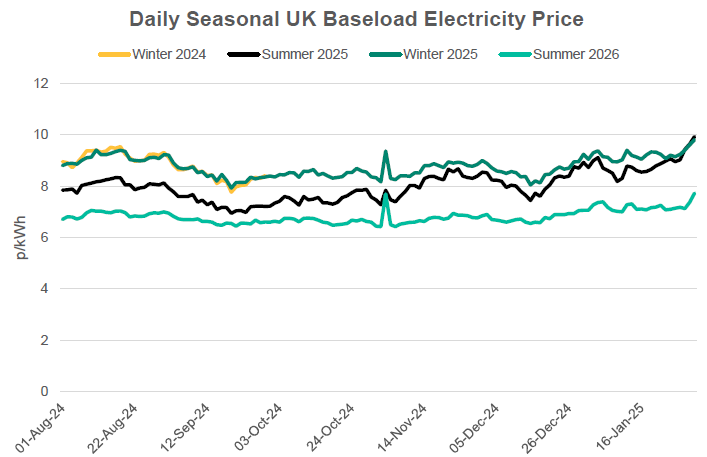

Seasonal Prices

Price Table

Prices across the board rose through January with the cold weather and low renewable output driving a large increase in power spot prices. Front season prices for gas and power rose about 10% as pressure rises on the summer 25 contract as storage levels continue to diminish.

Month End Prices

Spot Prices

| Fuel | Jan-25 (p/kWh) | Dec-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 4.58 | 4.23 | 8% |

| Power (UK Baseload) | 11.27 | 4.83 | 133% |

Front Months

| Fuel | Jan-25 (p/kWh) | Dec-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 4.53 | 3.54 | 28% |

| Power (UK Baseload) | 12.30 | 10.36 | 19% |

Front Season

| Fuel | Jan-25 (p/kWh) | Dec-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 4.37 | 3.99 | 9% |

| Power (UK Baseload) | 9.93 | 8.93 | 11% |

Annual Price (Apr-25)

| Fuel | Jan-25 (p/kWh) | Dec-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 4.16 | 3.91 | 6% |

| Power (UK Baseload) | 9.86 | 9.10 | 8% |

Historical Comparison

| Fuel | 2019 Average Front Season Price (p/kWh) | % Increase to Jan-25 |

|---|---|---|

| Gas (NBP) | 1.64 | 167% |

| Power (UK Baseload) | 5.10 | 95% |

Outlook

The cold weather currently shows little sign of abating which will continue to put pressure on supply and necessitate storage withdrawals. Prices are likely to remain under bullish pressure until milder temperatures arrive to ease supply concerns.

Bearish Signals

- Stable LNG supply as Europe remains the premium market.

- Limited planned maintenance in Norway means we should see a small rise in flows in February.

- Potential milder weather.

Bullish Signals

- February heating demand set to be lower than January but up when compared to recent years.

- Storage levels forecast to remain below recent years.

- Potential continuing cold weather.

Want the best energy and water contracts for your business?

Ginger Energy can help you.

We take the time to understand your needs and handle everything with the supplier on your behalf. Throughout the entire life on your contract, we’re always on hand to help. And, there’s obligation to stick with us – you contract directly with the supplier, not with you..

Get in touch today to start saving money and time spent on finding the best business energy deals.