As business energy consultants, we are constantly on the lookout for the finest deals on the market for our clients, and we work tirelessly to achieve these. Our monthly market reports provide views directly from our specialists. Use our price analysis, market signals, and political changes to help you make the right choice when it comes to energy decisions.

Download PDFDisclaimer: The information contained in this document has been prepared in good faith by Ginger Energy and provides our views on current/future trends and outcomes, but, as with all forecasts dependent upon multiple, complex variables, there is no certainty whatsoever that our forecasts will turn out to be correct. The information may be based on licenced 3rd party data, publicly available sources, assumptions, and observable market conditions and may change without notice. No warranty, express or implied, is made as to the accuracy, correctness, fitness for purpose, completeness or adequacy of this information nor is it intended to serve as basis for any procurement decision and as such Ginger Energy shall not accept any responsibility or liability for any action taken, financial or otherwise, as a result of this information. Please note that this email is intended for the recipient only and may not be copied, reproduced, or distributed without the prior consent of Ginger Energy.

Market Context

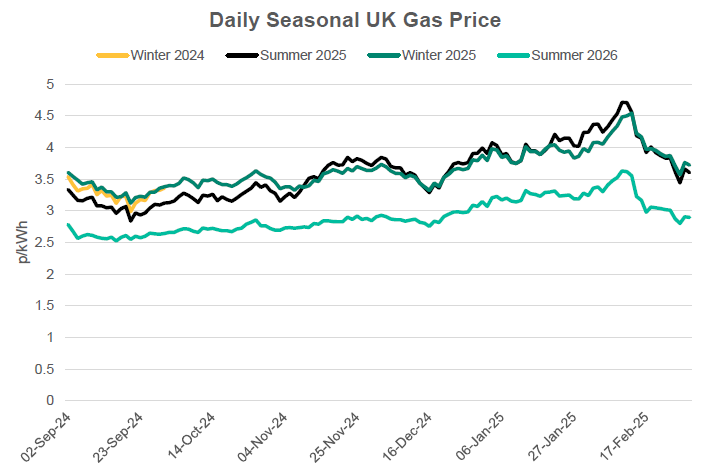

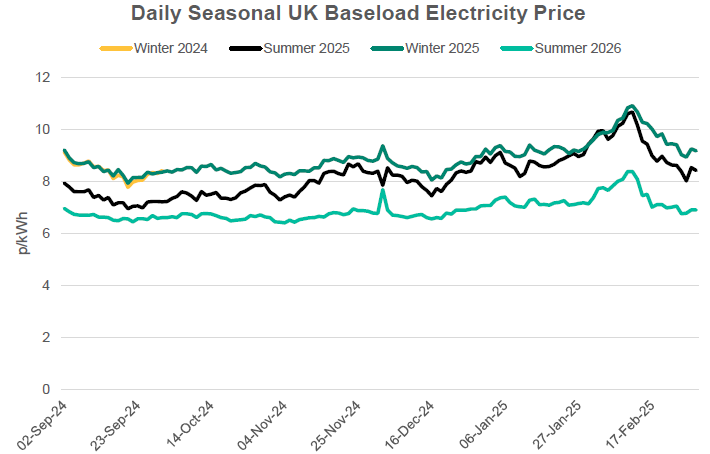

The first ten days of February witnessed front season prices rise around 10% due to cold weather and low storage levels. Prices then began to shed value due to “peace” talks regarding the conflict in Ukraine and rumours of potential changes to storage refilling targets. These stories combined with warmer weather creating looser near-term balance saw seasonal prices end the month 15-20% down on the end of January.

- A cold start to the month created a tight near-term market and the rising prompt prices echoed down the curve.

- Talks with world leaders, spearheaded by the US, about ending the conflict in Ukraine initially drove markets down but a public breakdown in relations between the US and Ukraine put doubts over a potential agreement.

- News came that the EU Commission is considering a relaxation of storage refilling targets but details yet to be released.

- Investors holding long summer positions to gain from the storage refilling requirement exited positions due to uncertainty which helped markets fall.

- A warmer end to the month reduced pressure on supply/demand balance and storage withdrawals.

- However, European storage remains low when compared to last two years.

In other news

- In other news President Trump has announced trade tariffs on Canada, Mexico, and China and has said the EU will “definitely” be next. This is negatively impacting the share price of many companies with European car manufacturers expected to be hardest hit. After meeting with Kier Starmer, there is a possibility that the UK could avoid tariffs.

Seasonal Prices

Price Table

Prices across the curve fell in February but not before hitting highs not seen for some time. Front season prices rose over 10% in the first week of the month then dropped almost 30% from 10th to the 25th of the month ending the February 15-20% down on the end of January.

Month End Prices

Spot Prices

| Fuel | Feb-25 (p/kWh) | Jan-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.65 | 4.58 | -20% |

| Power (UK Baseload) | 9.75 | 11.27 | -13% |

Front Months

| Fuel | Feb-25 (p/kWh) | Jan-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.59 | 4.53 | -14% |

| Power (UK Baseload) | 9.35 | 12.30 | -24% |

Front Season

| Fuel | Feb-25 (p/kWh) | Jan-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.60 | 4.37 | -17% |

| Power (UK Baseload) | 8.41 | 9.93 | -15% |

Annual Price (Apr-25)

| Fuel | Feb-25 (p/kWh) | Jan-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.69 | 4.16 | -11% |

| Power (UK Baseload) | 8.83 | 9.86 | -10% |

Historical Comparison

| Fuel | 2019 Average Front Season Price (p/kWh) | % Increase to Feb-25 |

|---|---|---|

| Gas (NBP) | 1.64 | 120% |

| Power (UK Baseload) | 5.10 | 65% |

Outlook

The outlook is currently mixed with both bullish and bearish potential. Whether the strong bearish trend witnessed through the second half of February continues or not is largely dependent on two ongoing stories. Positive developments in “peace” talks are likely to have a bearish impact but any further breakdowns are likely to see the market rise once more. Further news on the EU Commissions storage target changes also have the potential to move the market in either direction.

Bearish Signals

- Continued strong LNG supply as Europe remains the premium market.

- Any confirmation of loosening of storage refilling targets.

- Any positive developments in ending the conflict in Ukraine.

Bullish Signals

- Storage levels forecast to end the heating season at lowest level for many years.

- A potential breakdown in “peace” talks.

- Potential for cold snaps late in the winter season, although none are currently showing in the forecasts.

Want the best energy and water contracts for your business?

Ginger Energy can help you.

We take the time to understand your needs and handle everything with the supplier on your behalf. Throughout the entire life on your contract, we’re always on hand to help. And, there’s obligation to stick with us – you contract directly with the supplier, not with you..

Get in touch today to start saving money and time spent on finding the best business energy deals.