As business energy consultants, we are constantly on the lookout for the finest deals on the market for our clients, and we work tirelessly to achieve these. Our monthly market reports provide views directly from our specialists. Use our price analysis, market signals, and political changes to help you make the right choice when it comes to energy decisions.

Download PDFDisclaimer: The information contained in this document has been prepared in good faith by Ginger Energy and provides our views on current/future trends and outcomes, but, as with all forecasts dependent upon multiple, complex variables, there is no certainty whatsoever that our forecasts will turn out to be correct. The information may be based on licenced 3rd party data, publicly available sources, assumptions, and observable market conditions and may change without notice. No warranty, express or implied, is made as to the accuracy, correctness, fitness for purpose, completeness or adequacy of this information nor is it intended to serve as basis for any procurement decision and as such Ginger Energy shall not accept any responsibility or liability for any action taken, financial or otherwise, as a result of this information. Please note that this email is intended for the recipient only and may not be copied, reproduced, or distributed without the prior consent of Ginger Energy.

Market Context

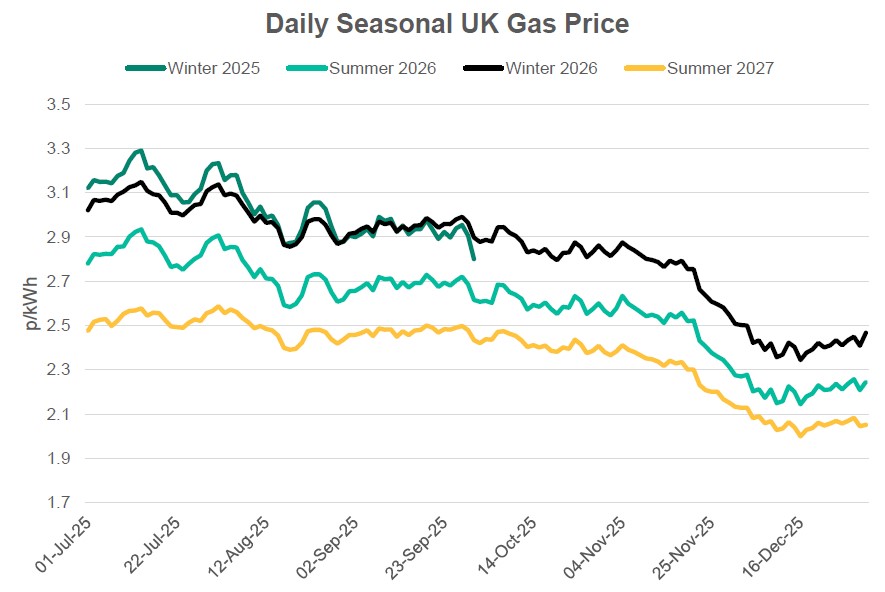

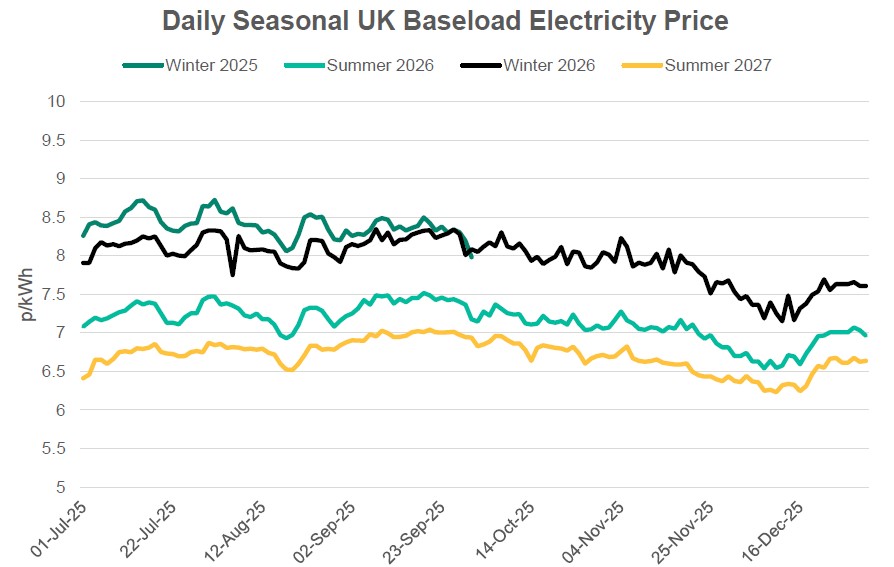

Seasonal gas prices steadied through December after the large decline witnessed during the back end of November. Peace talks continued but no deal was reached and fighting continued in Ukraine and Russia. A mild start to December was followed by a cold snap to end the month. As a result, front season gas and power prices concluded the month very close to the end of November levels.

- A flurry of meetings between leaders and diplomats from Ukraine, Russia, Europe, and the US took place throughout the month. There continued to be a push for peace although a gap remains in what each side of the conflict would deem acceptable. Territory and security guarantees continue to be large points of contention.

- Fighting on the ground continues with energy infrastructure seemingly key targets for both sides.

- Ukraine has established new gas and LNG import routes via Greece and Azerbaijan to bolster supply resilience. While Russia set four consecutive daily export records via the Power of Siberia pipeline, underscoring its strategic pivot toward China.

- EU storage remains at low levels when compared to the 5-year average but continued strong LNG flows to the continent kept prices subdued.

- December ended with EU aggregated storage at 61% versus a 5-year average of 74% with the cold snap at the end of the month sharply diminishing reserves.

- The first week of January has witnessed some major geopolitical events due to US foreign policy decisions. These events continue to impact global commodity markets.

In other news

- In December, the National Energy System Operator (NESO) issued the draft transmission network use of system (TNUoS) charges for April 2026-March 2027. TNUoS charges are likely to increase by between 50% and 100% for many customer types which will result in large growth in electricity standing charges. However, the rise is less than forecasts suggested in August. The cost increases are being levied because the UK electricity network requires huge investment to manage the transition to a greener more distributed grid.

Seasonal Prices

Price Table

Despite the cold weather spot gas prices remained subdued as strong supply kept the UK balance relatively comfortable. Cold, calm weather saw Electricity spot prices increase due to lower renewable output. Further down the curve, prices moved within a narrow range for the month consolidating the losses seen at the end of November.

Month End Energy Only Prices

Spot Prices

| Fuel | December-25 (p/kWh) | November-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.43 | 2.60 | -7% |

| Power (UK Baseload) | 7.35 | 6.27 | 17% |

Front Months

| Fuel | December-25 (p/kWh) | November-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.59 | 2.55 | 2% |

| Power (UK Baseload) | 8.41 | 8.06 | 4% |

Front Season

| Fuel | December-25 (p/kWh) | November-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.25 | 2.31 | -3% |

| Power (UK Baseload) | 6.96 | 6.81 | 2% |

Annual Price (Apr-26)

| Fuel | December-25 (p/kWh) | November-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.40 | 2.48 | -3% |

| Power (UK Baseload) | 7.32 | 7.29 | 0% |

Outlook

Moving further into the winter, geopolitics will continue to drive market movements but as EU storage depletes, fundamentals will begin to become more influential. The latest long-term weather forecasts are currently mixed but prolonged cold spells will put pressure on prices and, LNG flows will need to stay high to make up for the comparatively low storage levels across Northwest Europe. Unpredictable U.S foreign policy has the potential to provide both bullish and bearish signals to the market with the recent engagement in Venezuela creating the possibility of a glut of oil exports from the country.

Bearish Signals

- Any positive developments in the peace negotiations between Russia and Ukraine.

- Continued strong LNG flows to Europe with limited competition from Asia.

- Potential drop in oil prices given geopolitical developments in Venezuela.

Bullish Signals

- Peace negotiations could lose momentum.

- Possible LNG supply issues due to outages or transportation disruption.

- Cold weather would continue to see EU storage depleted at an accelerated rate.

Want the best energy and water contracts for your business?

Get in touch today to start saving money and time spent on finding the best business energy deals.