As business energy consultants, we are constantly on the lookout for the finest deals on the market for our clients, and we work tirelessly to achieve these. Our monthly market reports provide views directly from our specialists. Use our price analysis, market signals, and political changes to help you make the right choice when it comes to energy decisions.

Download PDFDisclaimer: The information contained in this document has been prepared in good faith by Ginger Energy and provides our views on current/future trends and outcomes, but, as with all forecasts dependent upon multiple, complex variables, there is no certainty whatsoever that our forecasts will turn out to be correct. The information may be based on licenced 3rd party data, publicly available sources, assumptions, and observable market conditions and may change without notice. No warranty, express or implied, is made as to the accuracy, correctness, fitness for purpose, completeness or adequacy of this information nor is it intended to serve as basis for any procurement decision and as such Ginger Energy shall not accept any responsibility or liability for any action taken, financial or otherwise, as a result of this information. Please note that this email is intended for the recipient only and may not be copied, reproduced, or distributed without the prior consent of Ginger Energy.

Market Context

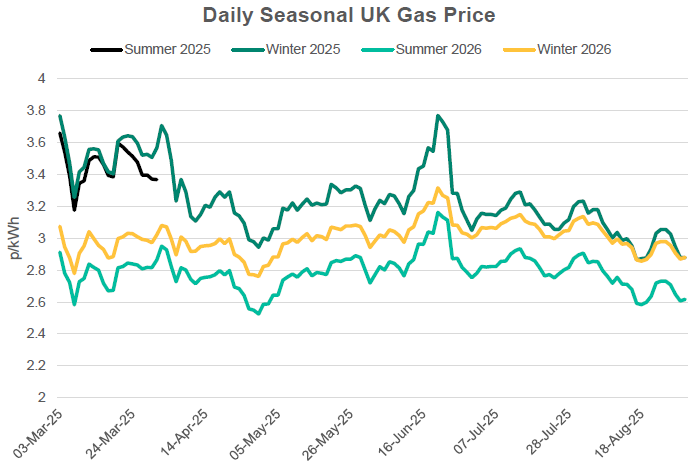

Seasonal gas prices trended down through August with the main bearish sentiment being driven by revived peace talks between Ukraine and Russia. Winter-25 gas prices reached their lowest level since April-24 before retracing some of those losses to end the month 10% lower than the end of July.

- Prices began to descend when it was announced President Trump would meet President Putin in Alaska to discuss the conflict.

- The bearish sentiment continued as President Trump hosted a meeting with President Zelensky who was accompanied by European leaders.

- The downward momentum paused as news went quiet with seemingly little progress being made whilst attacks intensified from both Russia and Ukraine.

- Further sanctions were placed on buyers of Russian oil whilst OPEC+ nations announced a hike in output helping to offset any potential supply issues caused by the sanctions.

- LNG demand remained low in Asia keeping European prices subdued. Supply to Europe is up 20% year-on-year.

- EU storage ended August at 77% which is positive given the low level at the start of summer but around 10% lower than the 5-year average.

In other news

- The number of data centres in the UK is forecast to increase by almost a fifth. However, there are concerns about the huge amount of energy and water the new data centres will consume. Some experts have warned it could drive up prices paid by consumers. According to the National Energy System Operator, NESO, the projected growth of data centres in Great Britain could “add up to 71 TWh (15-20%) to UK electricity demand” in the next 25 years, which it says redoubles the need for clean power – such as offshore wind.

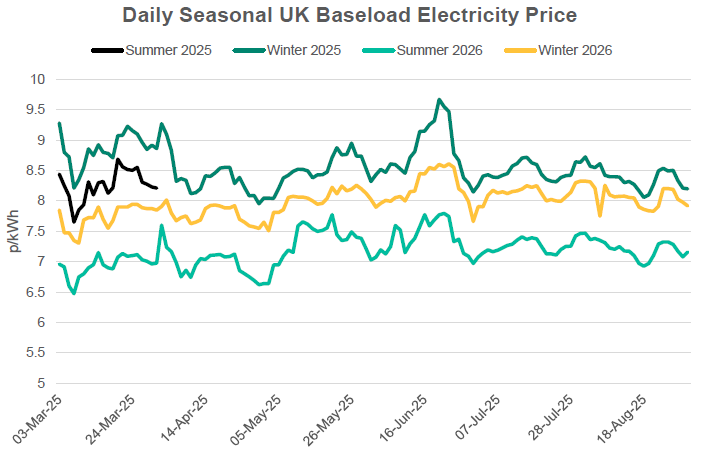

Seasonal Prices

Price Table

Prices across the curve descended month-on-month with front season gas prices hitting their lowest levels in around 18-months thanks to improved fundamentals and progress seemingly being made on a peace deal in Ukraine.

Month End Energy Only Prices

Spot Prices

| Fuel | August-25 (p/kWh) | July-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.66 | 2.84 | -6% |

| Power (UK Baseload) | 8.25 | 8.23 | 0% |

Front Months

| Fuel | August-25 (p/kWh) | July-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.67 | 2.85 | -6% |

| Power (UK Baseload) | 7.52 | 7.74 | -3% |

Front Season

| Fuel | August-25 (p/kWh) | July-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.88 | 3.23 | -11% |

| Power (UK Baseload) | 8.20 | 8.72 | -6% |

Annual Price (Oct-25)

| Fuel | August-25 (p/kWh) | July-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 2.80 | 3.14 | -11% |

| Power (UK Baseload) | 7.73 | 8.16 | -5% |

Outlook

Norway is set for its biggest gas infrastructure maintenance month but barring any prolonged extensions the risk should already be factored into prices. The storage outlook should continue to improve if LNG keeps arriving in Europe. Any further developments on potential peace in Ukraine could add further bearish pressure. With a stable fundamental outlook, geopolitical news will continue to be a large driver of price direction.

Bearish Signals

- Norwegian maintenance completed with no extensions/outages.

- Continued strong supply of LNG to Europe.

- Possible further progress on peace in Ukraine.

Bullish Signals

- Unplanned outages or extensions to Norwegian gas infrastructure maintenance.

- Potential damage to Ukrainian and Russian gas infrastructures as fighting intensifies.

- Possible issues with French nuclear fleet as safety check are typically carried out during September.

Want the best energy and water contracts for your business?

Ginger Energy can help you.

We take the time to understand your needs and handle everything with the supplier on your behalf. Throughout the entire life on your contract, we’re always on hand to help. And, there’s obligation to stick with us – you contract directly with the supplier, not with you..

Get in touch today to start saving money and time spent on finding the best business energy deals.