As business energy consultants, we are constantly on the lookout for the finest deals on the market for our clients, and we work tirelessly to achieve these. Our monthly market reports provide views directly from our specialists. Use our price analysis, market signals, and political changes to help you make the right choice when it comes to energy decisions.

Download PDFDisclaimer: The information contained in this document has been prepared in good faith by Ginger Energy and provides our views on current/future trends and outcomes, but, as with all forecasts dependent upon multiple, complex variables, there is no certainty whatsoever that our forecasts will turn out to be correct. The information may be based on licenced 3rd party data, publicly available sources, assumptions, and observable market conditions and may change without notice. No warranty, express or implied, is made as to the accuracy, correctness, fitness for purpose, completeness or adequacy of this information nor is it intended to serve as basis for any procurement decision and as such Ginger Energy shall not accept any responsibility or liability for any action taken, financial or otherwise, as a result of this information. Please note that this email is intended for the recipient only and may not be copied, reproduced, or distributed without the prior consent of Ginger Energy.

Market Context

In March seasonal prices were relatively stable when compared to the volatility witnessed in February. With the backdrop of peace talks regarding the conflict in Russia/Ukraine, and the arrival of some warmer temperatures, front season gas prices dropped 9% as the Winter season ended.

- Peace talks between the US, Ukraine and Russia dominated the headlines with a mixed picture in terms of how close a deal may be. President Trump appeared to be getting frustrated with both sides and the amount of time it is taking to reach an agreement.

- A cessation of attacks on energy infrastructure for 30-days was apparently agreed on 18th March, however, both sides have accused the other of breaking the terms of the agreement.

- The EU Commission held the storage filling targets after some thought they may be relaxed. As it stands, EU storage will need to be at 90% by 1st November but intermediary targets have been removed to try and help provide more flexibility for countries to reach the target.

- Rumours began that piped gas could start to flow back to Europe from Russia along with the LNG that continues to arrive on the continent (despite the strong anti Russia rhetoric from the EU). It is thought that a deal on energy could form part of a longer lasting peace agreement brokered by the US.

- Warmer temperatures arrived slightly reducing the pressure on storage and allowing for much needed injections to begin.

- EU storage ended the winter season below 30% very close to the bottom of the 5-year range, and far below the last two years without Russian piped gas. The pressure is now on to fill storage ready for next winter.

In other news

- In other news, for the first time ever renewables generated more than half the UK’s electricity in 2024. This was a substantial increase on the previous high of 46.4% seen in 2023 with 50.8% of the Uk’s electricity generation coming from sources such as wind, solar, and hydro.

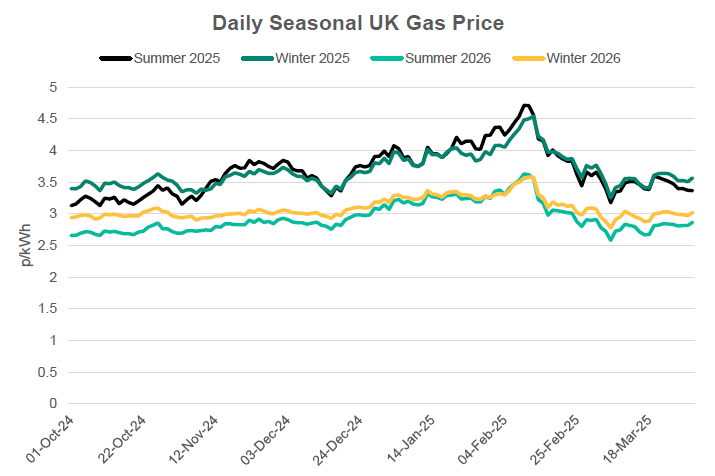

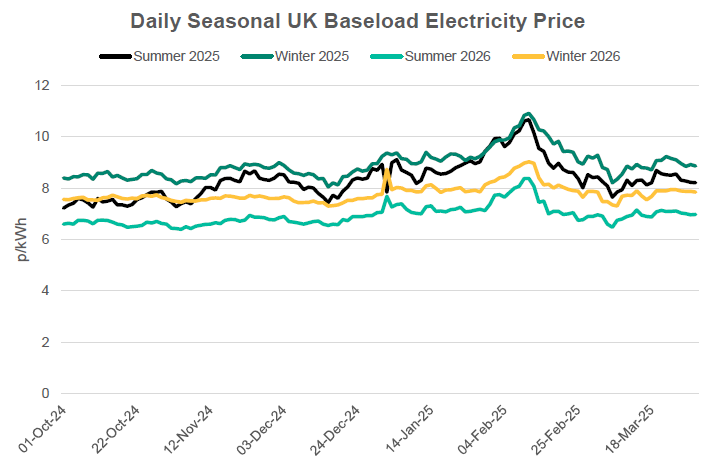

Seasonal Prices

Price Table

Prices continued to descend in March but at a much slower pace than was witnessed in the back half of February. Front season gas prices dropped 9% overall with the high of the witnessed at the very start of March. They dropped as much as 13% in the first week before rebounding slightly over the rest of the month.

Month End Prices

Spot Prices

| Fuel | Mar-25 (p/kWh) | Feb-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.34 | 3.65 | -9% |

| Power (UK Baseload) | 8.79 | 9.75 | -10% |

Front Months

| Fuel | Mar-25 (p/kWh) | Feb-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.33 | 3.59 | 4% |

| Power (UK Baseload) | 8.63 | 9.35 | -8% |

Front Season

| Fuel | Mar-25 (p/kWh) | Feb-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.37 | 3.60 | -7% |

| Power (UK Baseload) | 8.21 | 8.41 | -2% |

Annual Price (Apr-25)

| Fuel | Mar-25 (p/kWh) | Feb-25 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.51 | 3.69 | -5% |

| Power (UK Baseload) | 8.57 | 8.83 | -3% |

Historical Comparison

| Fuel | 2019 Average Front Season Price (p/kWh) | % Increase to Mar-25 |

|---|---|---|

| Gas (NBP) | 1.64 | 106% |

| Power (UK Baseload) | 5.10 | 61% |

Outlook

The outlook over the coming months is skewed towards upside as we enter storage injection season. With EU gas stocks at very low levels, it is going to be a huge challenge to refill to the 90% target by the 1st November. This will require a strong steady flow of LNG and a problem free maintenance schedule. Eyes will also remain on the peace talks between the US, Ukraine, and Russia.

Bearish Signals

- Potential positive outcome to Russia/Ukraine peace talks.

- Any confirmation of loosening of storage refilling targets.

- LNG supply is expected to increase versus last summer.

Bullish Signals

- Very low storage levels.

- A potential breakdown in Russia/Ukraine peace talks

- Summer maintenance on gas infrastructure across Europe.

- Impact of US tariffs.

Want the best energy and water contracts for your business?

Ginger Energy can help you.

We take the time to understand your needs and handle everything with the supplier on your behalf. Throughout the entire life on your contract, we’re always on hand to help. And, there’s obligation to stick with us – you contract directly with the supplier, not with you..

Get in touch today to start saving money and time spent on finding the best business energy deals.