As business energy consultants, we are constantly on the lookout for the finest deals on the market for our clients, and we work tirelessly to achieve these. Our monthly market reports provide views directly from our specialists. Use our price analysis, market signals, and political changes to help you make the right choice when it comes to energy decisions.

Download PDFDisclaimer: The information contained in this document has been prepared in good faith by Ginger Energy and provides our views on current/future trends and outcomes, but, as with all forecasts dependent upon multiple, complex variables, there is no certainty whatsoever that our forecasts will turn out to be correct. The information may be based on licenced 3rd party data, publicly available sources, assumptions, and observable market conditions and may change without notice. No warranty, express or implied, is made as to the accuracy, correctness, fitness for purpose, completeness or adequacy of this information nor is it intended to serve as basis for any procurement decision and as such Ginger Energy shall not accept any responsibility or liability for any action taken, financial or otherwise, as a result of this information. Please note that this email is intended for the recipient only and may not be copied, reproduced, or distributed without the prior consent of Ginger Energy.

Market Context

Prices lost value through the start of December retreating from recent highs. Warmer weather forecasts eased the concerns created by the strong storage withdrawals through November and, as a result, front season prices dropped around 10%. However, from mid-month the sentiment turned, prices rose sharply as cold weather set-in eradicating the earlier losses to end the month up 5% on the end of November, and the highest level for the year.

- Warmer weather forecasts slightly calmed supply fears after strong withdrawals throughout November but the sentiment turned on the arrival of cold weather.

- The return of nuclear capacity and stronger wind production reduced gas-for-power demand.

- LNG arrivals and sendout remained strong through the month.

- No new transit agreement for Russian piped gas to Europe through Ukraine was arranged, therefore, as expected, the flows halted after 31st December.

- The flows only represented around 3-4% of European demand, however, as the overall system balance remains tight (since the removal of the larger flows to Europe from Russia) the loss of this gas adds pressure to European supply.

- Withdrawals slowed through early December with Northwest Europe storage ending the month at around 69% vs the 5-year average of 75%.

In other news

- Four UK nuclear power stations have had their operating life extended in a welcome boost for energy security with the decision supporting around 3,000 jobs. The Secretary of State for Energy and Net Zero, Ed Miliband said keeping the plants online is a “strong endorsement of our clean power mission”.

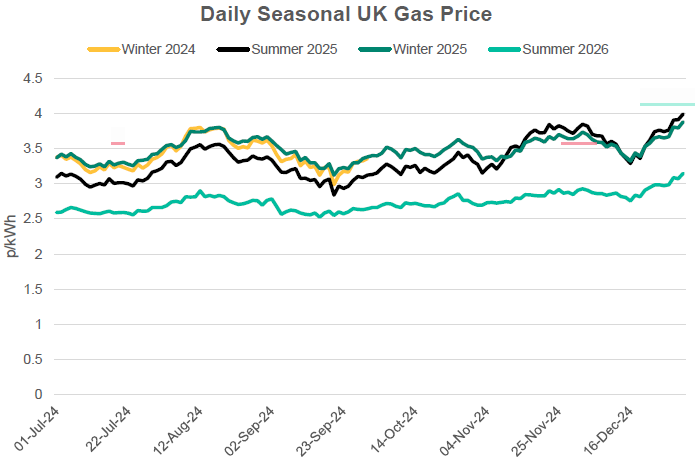

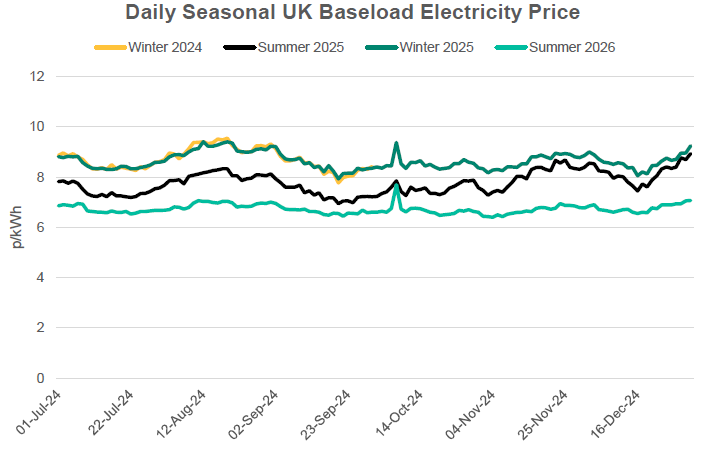

Seasonal Prices

Price Table

Seasonal prices ended the year at the highest level witnessed throughout 2024. The bearish movement at the start of the month was completely wiped out by the end of the month with prices rising around 5% month-on-month. Power spot prices continue to be divorced from wider markets due to a complex set of intraday drivers creating large amounts of volatility.

Month End Prices

Spot Prices

| Fuel | Dec-24 (p/kWh) | Nov-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 4.23 | 3.98 | 6% |

| Power (UK Baseload) | 4.83 | 9.41 | -49% |

Front Months

| Fuel | Dec-24 (p/kWh) | Nov-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 4.16 | 4.01 | 31% |

| Power (UK Baseload) | 10.36 | 9.28 | 12% |

Front Season

| Fuel | Dec-24 (p/kWh) | Nov-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.99 | 3.79 | 5% |

| Power (UK Baseload) | 8.93 | 8.39 | 6% |

Annual Price (Apr-25)

| Fuel | Dec-24 (p/kWh) | Nov-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.91 | 3.71 | 5% |

| Power (UK Baseload) | 9.10 | 8.64 | 5% |

Historical Comparison

| Fuel | 2019 Average Front Season Price (p/kWh) | % Increase to Dec-24 |

|---|---|---|

| Gas (NBP) | 1.64 | 144% |

| Power (UK Baseload) | 5.10 | 75% |

Outlook

The outlook is currently mixed after the recent bullish run. Further cold weather across the continent will continue to keep the market nervous as storage continues to be depleted but assumptions are that much of the weather risk has already been factored into prices.

Bearish Signals

- Flat demand due to warmer weather forecasts for January and continued weakness in manufacturing sector.

- Softer gas-for-power demand due to higher nuclear availability.

- LNG arrivals set to continue to rise through January.

Bullish Signals

- Requirement for more gas to flow from elsewhere in Europe to replace Russian piped gas through Ukraine.

- Storage levels forecast to remain below recent years.

Want the best energy and water contracts for your business?

Ginger Energy can help you.

We take the time to understand your needs and handle everything with the supplier on your behalf. Throughout the entire life on your contract, we’re always on hand to help. And, there’s obligation to stick with us – you contract directly with the supplier, not with you..

Get in touch today to start saving money and time spent on finding the best business energy deals.