As business energy consultants, we are constantly on the lookout for the finest deals on the market for our clients, and we work tirelessly to achieve these. Our monthly market reports provide views directly from our specialists. Use our price analysis, market signals, and political changes to help you make the right choice when it comes to energy decisions.

Download PDFDisclaimer: The information contained in this document has been prepared in good faith by Ginger Energy and provides our views on current/future trends and outcomes, but, as with all forecasts dependent upon multiple, complex variables, there is no certainty whatsoever that our forecasts will turn out to be correct. The information may be based on licenced 3rd party data, publicly available sources, assumptions, and observable market conditions and may change without notice. No warranty, express or implied, is made as to the accuracy, correctness, fitness for purpose, completeness or adequacy of this information nor is it intended to serve as basis for any procurement decision and as such Ginger Energy shall not accept any responsibility or liability for any action taken, financial or otherwise, as a result of this information. Please note that this email is intended for the recipient only and may not be copied, reproduced, or distributed without the prior consent of Ginger Energy.

Market Context

November witnessed prices rise sharply due to cold weather, low renewable output, and an escalation in the Russia/Ukraine conflict. The ceasefire between Hezbollah and Israel retraced a small amount of the gains in the final days of the month but front season gas prices increased around 20% overall.

- Russia cut off gas to Austrian Oil Mineral Administration (OMV) which scared the market into thinking a large amount of the remaining flows via Ukraine would stop earlier than the end of the year. However, flows remained stable for the month as new buyers were seemingly found.

- A cold snap in the UK put pressure on supply – LNG responded with cargoes being diverted from Asia to the UK.

- The Russia / Ukraine war intensified with Russia targeting energy infrastructure, utilising new weapons, and President Putin’s escalating rhetoric.

- The combination of cold weather and low renewable generation caused storage to be depleted to around 86% with large withdrawals taking place for the time of year.

- Donald Trump won the Presidential race in the U.S. and will take office for a second term in January 25. The market reaction has so far been muted as the world awaits further details on his domestic and foreign policies.

In other news

- The Uk price cap was announced for January ‘25 at £1,738 a year for a “typical” dual fuel household increasing 1.2% from the October cap. Unit rates will be capped at 6.34p/kWh for gas and 24.86 p/kWh for electricity until 31st March 2025.

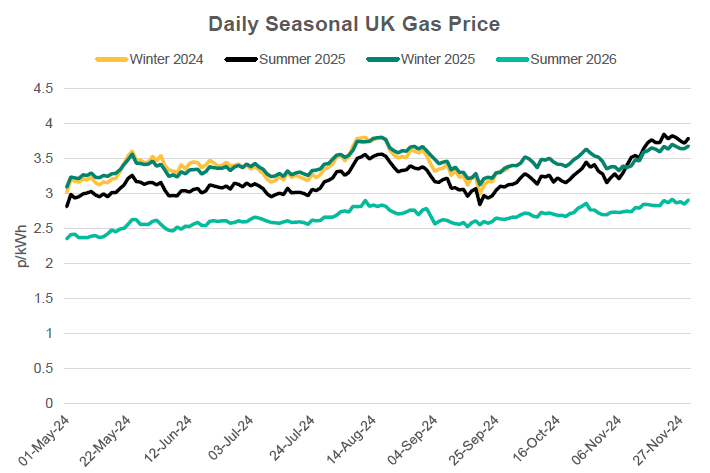

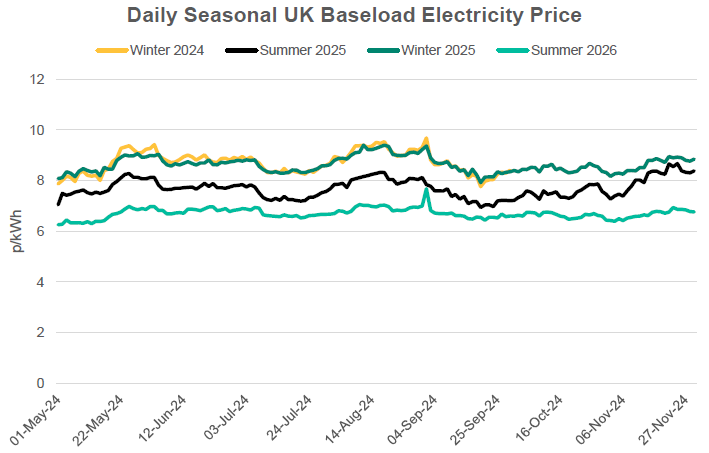

Seasonal Prices

Price Table

Prices rose across the board throughout November with gas prices generally rising more than the electricity equivalent. Front month gas prices saw the largest increases as cold weather depleted European storage increasing pressure on the remaining winter months.

Month End Prices

Spot Prices

| Fuel | Nov-24 (p/kWh) | Oct-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.98 | 3.36 | 19% |

| Power (UK Baseload) | 9.41 | 9.01 | 4% |

Front Months

| Fuel | Nov-24 (p/kWh) | Oct-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 4.01 | 3.44 | 33% |

| Power (UK Baseload) | 9.28 | 8.85 | 5% |

Front Season

| Fuel | Nov-24 (p/kWh) | Oct-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.79 | 3.28 | 16% |

| Power (UK Baseload) | 8.39 | 7.46 | 12% |

Annual Price (Oct-24)

| Fuel | Nov-24 (p/kWh) | Oct-24 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.71 | 3.40 | 9% |

| Power (UK Baseload) | 8.64 | 7.94 | 9% |

Historical Comparison

| Fuel | 2019 Average Front Season Price (p/kWh) | % Increase to Nov-24 |

|---|---|---|

| Gas (NBP) | 1.64 | 131% |

| Power (UK Baseload) | 5.10 | 64% |

Outlook

The outlook is currently mixed after the recent bullish run. Weather forecasts have been adjusted up and a fragile de-escalation of the Middle East conflict provide bearish signals. Adversely tensions in Ukraine and Russia are ratcheting up. Further cold weather across the continent will continue to keep the market nervous as storage depletes early in the season but assumptions are that much of the weather risk has already been factored into prices.

Bearish Signals

- Increased Norwegian production with minimum maintenances.

- Gas-for-power returning to more normal levels with higher renewable output.

- Further de-escalation in the Middle East.

Bullish Signals

- Potential cold weather increasing heating demand.

- NWE storage levels below recent years and the gap is forecast to widen.

- Geopolitical uncertainty in Middle East and Ukraine/Russia.

Want the best energy and water contracts for your business?

Ginger Energy can help you.

We take the time to understand your needs and handle everything with the supplier on your behalf. Throughout the entire life on your contract, we’re always on hand to help. And, there’s obligation to stick with us – you contract directly with the supplier, not with you..

Get in touch today to start saving money and time spent on finding the best business energy deals.