As business energy consultants, we always have our finger on the pulse, working tireless to help our customers get the best deal on the market. These monthly market reports give you insights directly from our experts. Use our price analysis, market signals, and political changes to help you make the right choice when it comes to your energy.

Download PDFDisclaimer: The information contained in this document has been prepared in good faith by Ginger Energy and provides our views on current/future trends and outcomes, but, as with all forecasts dependent upon multiple, complex variables, there is no certainty whatsoever that our forecasts will turn out to be correct. The information may be based on licenced 3rd party data, publicly available sources, assumptions, and observable market conditions and may change without notice. No warranty, express or implied, is made as to the accuracy, correctness, fitness for purpose, completeness or adequacy of this information nor is it intended to serve as basis for any procurement decision and as such Ginger Energy shall not accept any responsibility or liability for any action taken, financial or otherwise, as a result of this information. Please note that this email is intended for the recipient only and may not be copied, reproduced, or distributed without the prior consent of Ginger Energy.

Market Context

In November, The market settled back into the overall bearish trend we have witnessed throughout much of 2023 despite the cold snap experienced at the end of the month. The below averagetemperatures were met with ample supply providing confidence to the market keeping downward pressure on prices.

- A slowdown in volatility as geopolitical risk receded slightly with fears of contagion in the Middle East not materialising yet and a momentary ceasefire provided hope for longer lasting suspension to the conflict.

- A seizure of a cargo ship in the southern Red Sea by Yemen’s Houthi rebels amid the ongoing Israel-Hamas war failed to stoke fresh concerns over an escalation of the conflict to other parts of the Middle East. The vessel was not an LNG ship but demonstrated a potential risk to gas and oil supplies being transported through the Suez Canal.

- The Tamar gas field offshore Israel returned to operation after being shut-down after the October 7th attacks. Threats of strikes at Australian LNG plants continue to rumble on but Chevron are committed to resolving the issues and reaching a deal.

- Strong LNG arrivals and flows across the month.

- Colder weather led to an increase in demand which was met by growth in supply capacity and therefore created no cause for alarm.

- After Northwest Europe storage reached levels never previously observed, withdrawals began due to the cold weather, but levels remain much higher than the same time of year for the last 5 years.

In other news

At the end of November Ofgem announced the latest domestic price cap figures which will come into effect from January 1st

The new prices result in a rise in domestic energy bills of roughly 5% with households due to be paying more for energy than ever before.

The price cap was higher last winter, but Government support kept bills lower than the expected January ‘24 levels.

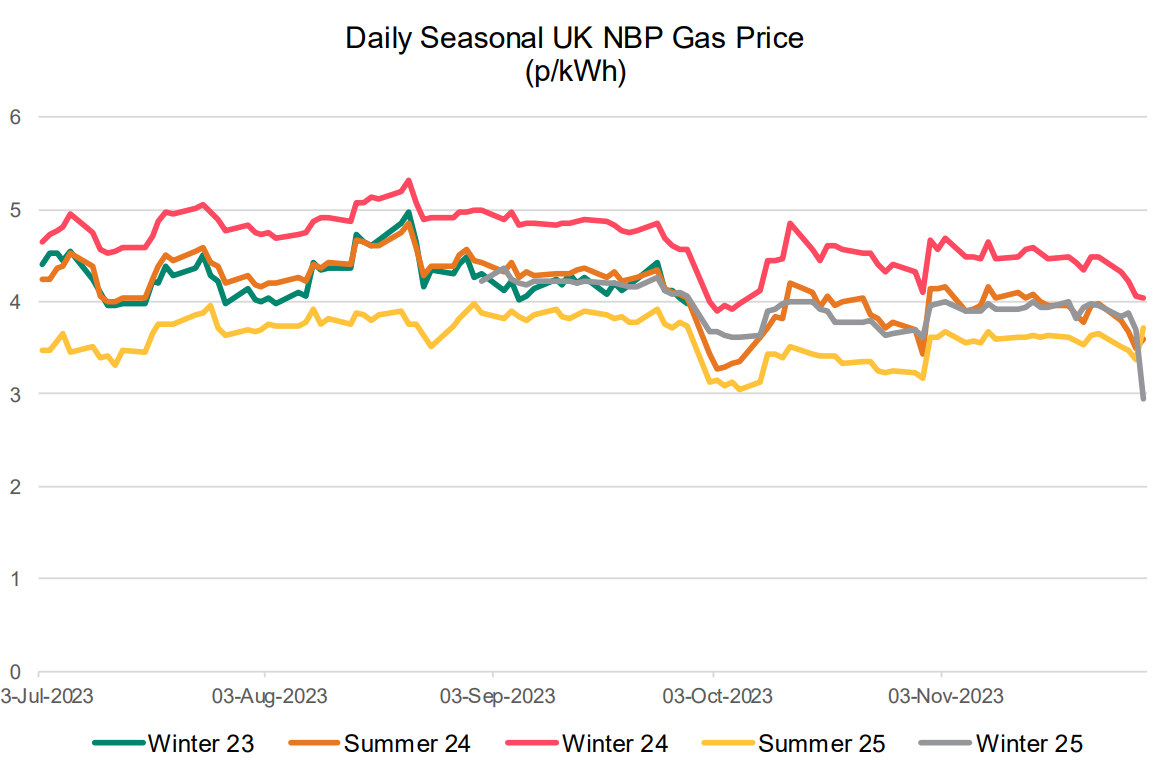

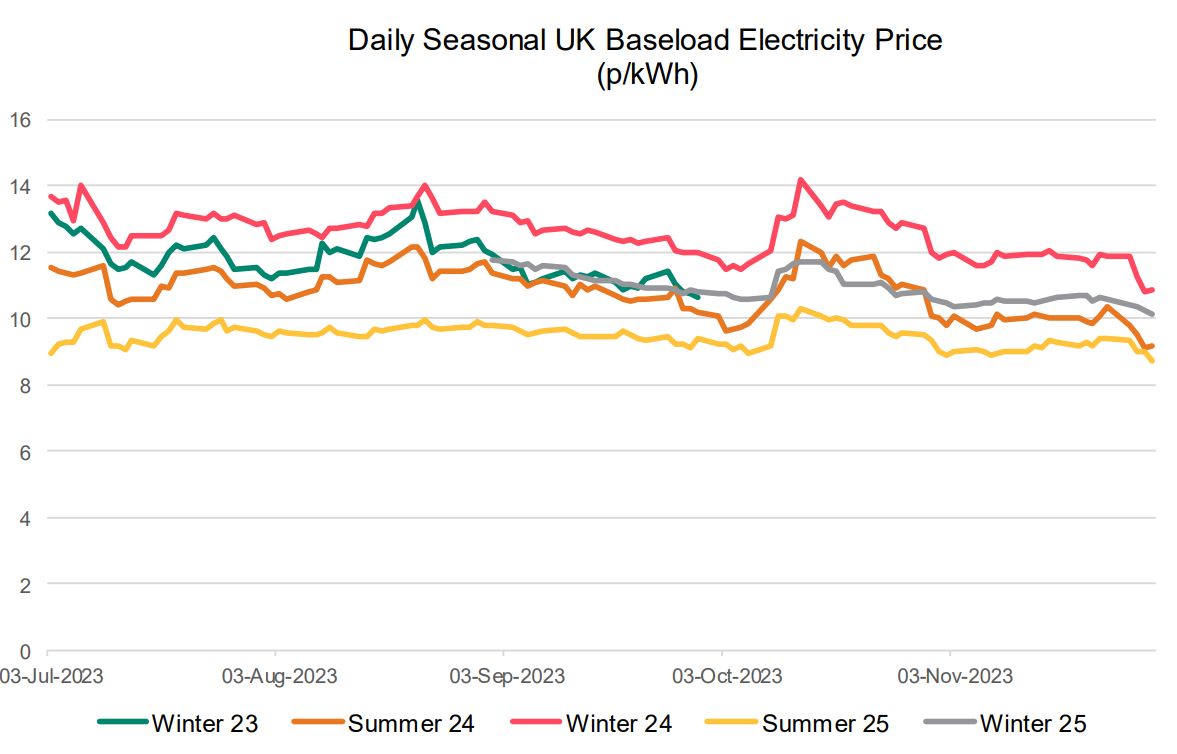

Seasonal Prices

Price Table

November saw a return to the general bearish trend that has been evident throughout 2023 forall future contracts. Spot prices demonstrated an increase as cold weather took hold at the end of the month.

Month End Prices

Spot Prices

| Fuel | Nov-23 (p/kWh) | Oct-23 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.64 | 3.48 | 5% |

| Power (UK Baseload) | 14.18 | 7.65 | 85% |

Front Months

| Fuel | Nov-23 (p/kWh) | Oct-23 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3.53 | 3.77 | -3% |

| Power (UK Baseload) | 9.09 | 10.72 | -15% |

Front Season

| Fuel | Nov-23 (p/kWh) | Oct-23 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 3,60 | 4.15 | -13% |

| Power (UK Baseload) | 9.15 | 10.07 | -9% |

Annual Price (Nov-23)

| Fuel | Nov-23 (p/kWh) | Oct-23 (p/kWh) | Month-on-Month Difference |

|---|---|---|---|

| Gas (NBP) | 4.90 | 4.60 | -15% |

| Power (UK Baseload) | 10.10 | 11.13 | -9% |

Historical Comparison

| Fuel | 2019 Average Front Season Price (p/kWh) | % Increase to Nov-23 |

|---|---|---|

| Gas (NBP) | 1.64 | 120% |

| Power (UK Baseload) | 5.10 | 79% |

Outlook

With the market now seemingly more comfortable with the geopolitical situation, direction will likely be driven more by fundamentals. So far the system has demonstrated its ability to meet the rising winter demand. If flows remain strong and storage high (for the time of year) the downward momentum will likely continue. However, weather forecasts for January will start to play a role in setting price direction.

Bearish Signals

- Any sort of de-escalation of the conflict.

- NWE gas storage forecast to remain at record high for the time of year by the end of December.

- French nuclear capacity up.

- Demand destruction in industrial sector is set to continue amid weak macro economic environment.

Bullish Signals

- Any sort of escalation of the conflict.

- Ramp up in heating demand due to cold weather

- Weather forecasts revised lower.

- Unplanned outages or disruption to supply infrastructure.

Want the best energy and water contracts for your business?

Ginger Energy can help you.

We take the time to understand your needs and handle everything with the supplier on your behalf. Throughout the entire life on your contract, we’re always on hand to help. And, there’s obligation to stick with us – you contract directly with the supplier, not with you.

Get in touch today to start saving money and time spent on finding the best business energy deals.